I’ve been a professional speculator in the resource industry for almost two decades now.

One year ago, I wrote a cautionary article on the cryptocurrency sector. I got more hate mail in my inbox that week than I had for any other article, “You’re a moron”, “This is the future” “You’re crazy” etc…

At the January 2018 VRIC, which is cohosted by Katusa Research and Cambridge House, I invited out the most followed guru in the crypto space to give his take on where the crypto world is going.

Even though I published my thoughts that the price of Bitcoin and the whole sector as a whole was in bubble territory, I kept an open mind. My goal was to create a forum of positive debate between the crypto world and my world.

The debate has been viewed over 100,000 times and I did my best to create a fair debate.

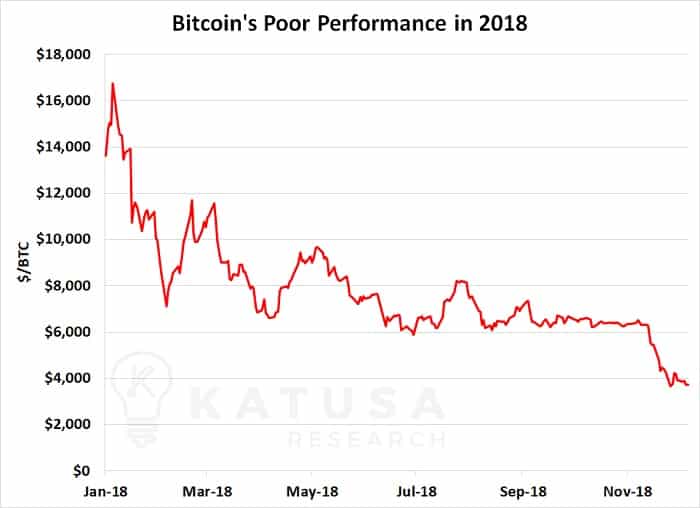

This past week Bitcoin fell below $4000, down a whopping 70% year to date.

But this isn’t a bash piece. I’ve been watching Bitcoin develop since 2010.

I even told my good friend and business partner Doug Casey that it had the potential to change SWIFT (Society for Worldwide Interbank Financial Telecommunication) in an internal memo while we worked at the same firm back then.

Yes it’s true, I introduced Bitcoin to the Casey Research world in early 2010.

As with any new sector, there are going to be mega highs and mega lows. The key is to not buy into the hype at the top and blow yourself up.

Unless you’re an ultra-early adopter it’s always better to let the market implode. And then pick up pieces of the remaining businesses at fractions to what they were trading at during the boom.

It is the Way of the Alligator.

So What Do I think will Happen to Bitcoin and Cryptocurrencies Now?

You will see more downside pressure as the Uncle Sam comes after his due taxes and accounts are forced to sell to pay the tax man.

There will be attempts to rally the price, but there is still a lot more cleansing to happen.

We have not seen the bottom in Bitcoin.

Bitcoin Aftermath – New, Better Companies Will Emerge from Crypto Ashes

Veteran investors from the dot-com crash or the resource sector have seen this game before.

The dot-com bubble of the late 90s played out exactly the same way. Hundreds of companies rode the soaring wave of investor sentiment in order to cash in on the hysteria.

Hysteria can only support valuations for so long, and eventually fundamentals take over.

The collapse of the technology sector resulted in many businesses being put to the test. Were their business models capable of sustaining themselves without the hype to prop it up?

For many companies, the answer was no.

Over 75% of tech companies founded during the bubble went bust.

However, from the ashes of the dot-com bubble would come some of the most recognizable names of our time.

Amazon, Google, eBay. Many of the most familiar household names today not only survived the crash, but came out stronger for it.

The chart below shows how the information technology weighting of the S&P 500 has grown to the point where it once again comprises a quarter of the S&P 500 index by value. This is close to where it was at the height of the dot-com bubble.

The moral of the story is this. After all the hype and mania is gone, the right companies will still be left standing. And they will be thriving.

And I foresee similar things happening in the crypto/blockchain space.

Regards,

Marin