Last week, the Organization of Petroleum Exporting Countries (OPEC) announced its intention to reduce its oil production by one million barrels per day. This is the first time OPEC has attempted a production cut since late 2008.

The promise of reduced oil supplies sent oil prices 5% higher on the day of the announcement.

OPEC’s announcement was a good soundbite for the media, but what you won’t hear from the mainstream press is that OPEC’s move will not make a difference. Contrary to what some people believe, it’s not going to lead to higher oil prices over the long term. Below, I’ll tell you why.

A Cartel That is Losing Its Power

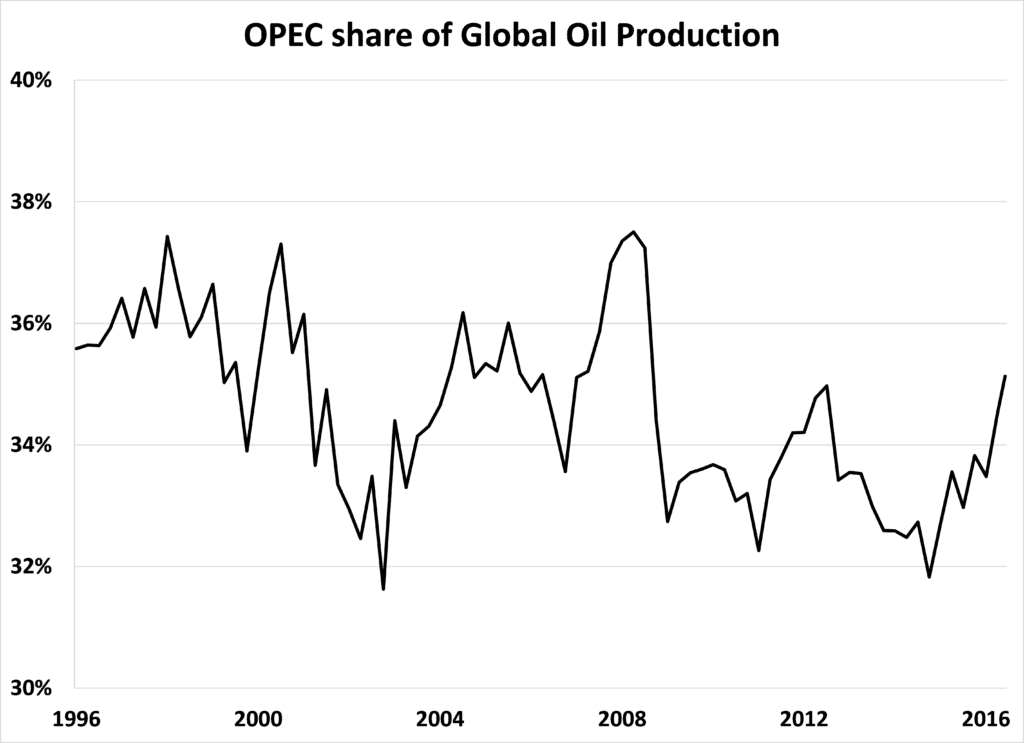

OPEC is a group of 14 countries: Saudi Arabia, Iraq, Iran, United Arab Emirates, Kuwait, Venezuela, Angola, Nigeria, Algeria, Qatar, Ecuador, Libya, and Gabon. For decades, OPEC has been a driving force in influencing the oil market. It has produced 30%-38% of the world’s oil for the past 20 years. Currently, OPEC produces 33.75 million barrels per day (35% of global oil production).

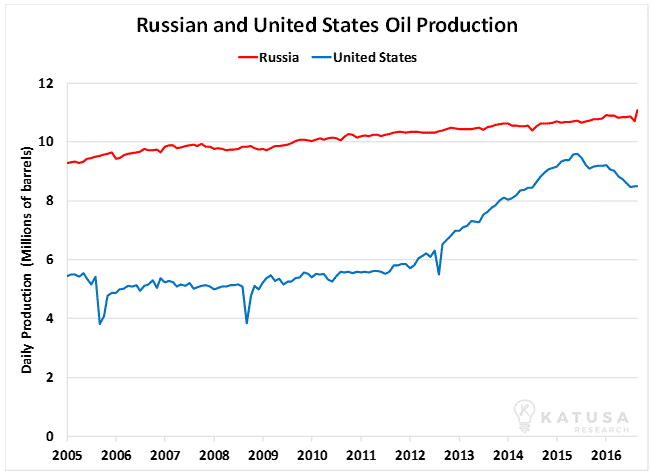

However, OPEC’s power is slowly eroding. This is because of Russia and fracking. Over the past 15 years, Russia has increased its oil production so much that it’s now the world’s largest oil producer. Fracking has helped the U.S. increase its oil production by over 70% over the past eight years. It now produces nearly as much oil as Russia. Russia and the U.S. are NOT part of OPEC. You can see the production increases in the following chart:

Thanks to the increased Russian and U.S. production, OPEC’s share of global oil production has been in a downtrend for the past 20 years.

In addition to knowing that OPEC doesn’t have the power it used to, you need to know that OPEC lies…all the time.

OPEC’s Long History of Ignoring Quotas

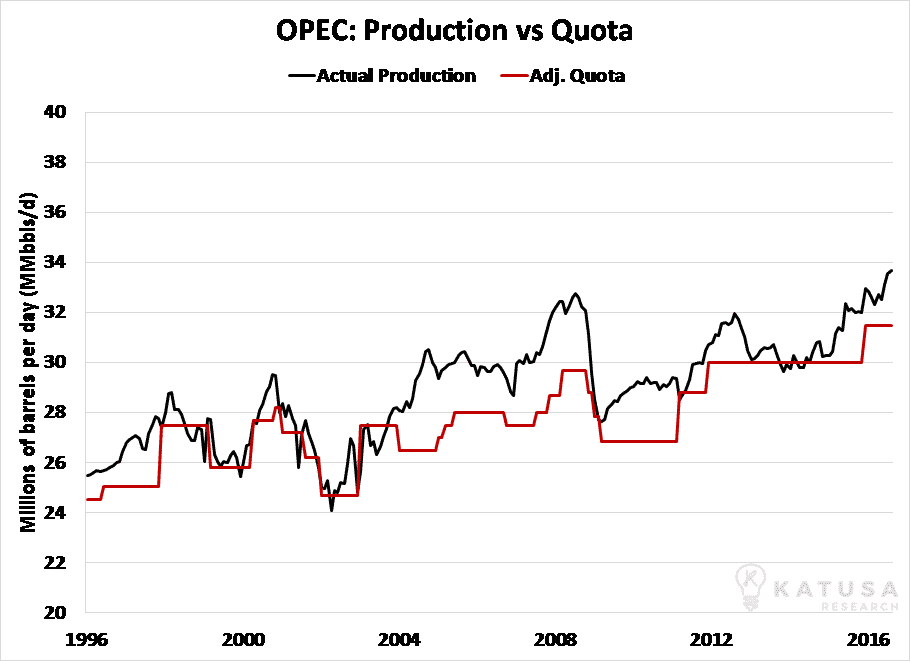

Surprisingly, almost no one is mentioning the fact that current OPEC production is more than two million barrels above its own self-designated quota.

We compiled the chart below exclusively from OPEC’s own documents to compare the organization’s production since 1996 and its stated quotas during the same period. You can see that it almost always produces more than its stated quotas. This is because individual OPEC members often need oil money more than they need to conform to the group’s rules. So, they pump more oil than the quotas allow.

History has proven that OPEC rarely produces within its stated quota.

OPEC currently produces 33.75 million barrels per day. If it does what it says it will do and cuts production by a million barrels per day, it is still well above the self-designated quota of 31.5 million barrels per day.

The production cut will narrow the gap between the target and actual production, but I am skeptical much will change. It is very hard for OPEC to reverse the strategy it has been following for the past year, which has been to “pump and dump” as much oil as it could.

It’s All About Market Share

The last time OPEC cut production in late 2008, it lost market share to the Russians, who increased production. It was a lesson OPEC will not forget. In 2014, I stated why OPEC can’t cut production for two reasons: Russia and North American shale oil production. Both sources can cut into OPEC’s market share if it cuts production. They won’t stop pumping.

OPEC is well aware of both the Russians and the innovation in shale production since the oil crash of 2014. OPEC does not want to lose that market share. I do not expect them to produce at or below their quota. OPEC production will slowly creep up towards current levels again and the quota will end up being raised.

Two years ago, I stated that “OPEC will lose this price war”, as OPEC pumped as much as it could in an attempt to force US shale producers and the Russians out of the market place. OPEC lost that war. Again, OPEC’s biggest problem is that Russia and the United States are not participating in the production cut.

Russia is pumping more oil today than ever.

The United States has dropped shale production costs by 50% in the last 24 months.

And we are just entering something I call “The Shale Revolution 2.0.” Technology is improving at an incredible pace, which is rapidly lowering the cost of shale oil production.

Pioneer Resources recently announced its operational costs were as low as $2.25 a barrel in the sweet spot of the Permian basin. The Permian basin produces 1.9 million barrels per day. To put it in perspective, if the Permian basin were a country, it would be the 7th largest producer in OPEC.

This OPEC cut (let’s pretend they actually cut by one million barrels) has caused–and will continue to–inflation in oil prices for the short term. However, like I said before, there’s nothing stopping the Russians (who benefit from a depreciated currency) or the Americans (who benefit from technological innovations in the shale sector) from increasing production.

Higher prices incentivize increased oil production, which will eventually push the price back down.

Why Hedging Will Put a Cap on Oil Prices

Another consequence of the weak oil market of the last 24 months is that oil companies are looking to lock in higher oil prices by hedging new production. The bankers who lent money to the oil companies will request it, management teams who got burnt in the last down cycle will also want to hedge, and most importantly, shareholders will want hedges in place to lock in enough cash flow to guarantee dividends in a negative interest rate world.

We will see North American oil producers begin to hedge production as oil creeps above $50/barrel. Significant hedging will occur between $55-$60 per barrel.

The takeaway from this short missive is that I expect the ceiling on oil prices in the $55 area to continue. I think OPEC’s latest move will prove to be a failed attempt to raise prices. I expect the cartel as a whole to continue to produce above its quota.

It has never been more critical to be invested in only the lowest-cost, highest-quality oil producers than it is today.

Regards,

Marin Katusa