Editor’s note: In this week’s edition, you‘ll find a collection of Marin’s “market notes” that detail some of the most important things happening in the market right now.

A Potential Fire Sale in High-Quality Oil and Gas Assets

***One of my favorite sources of investment ideas is the new lows list… the stocks sitting at their lowest point over the past year.

As a deep-value contrarian resource investor, I’m always looking for deeply depressed sectors. I’m looking for financial distress, bankruptcies, crashes, and crisis. As I put it in one of our most important educational essays:

A market crash creates huge opportunities because it introduces extreme amounts of emotion into the market. Market are rational most of the time. They price most assets correctly most of the time. But when emotion levels go off the charts–like they do in a crash–emotion completely overwhelms reason.

During a crash, terrified investors sell assets with no regard for their underlying values or ability to produce cash flow. During crashes, the price of assets becomes “unhinged” from the value of assets. If you can keep a level head while others are losing theirs, you can buy at fire sale prices.

I bring this up because we might soon see a fire sale in high quality U.S. oil and gas assets. This sector is under a lot of selling pressure right now. One of the top independent oil producers, Continental Resources is down 27% in the past two months. Top natural gas producer Range Resources is down 25% in the past two months (and down 42% in the past six months). Most oil and gas ETFs are at sitting at 2017 lows.

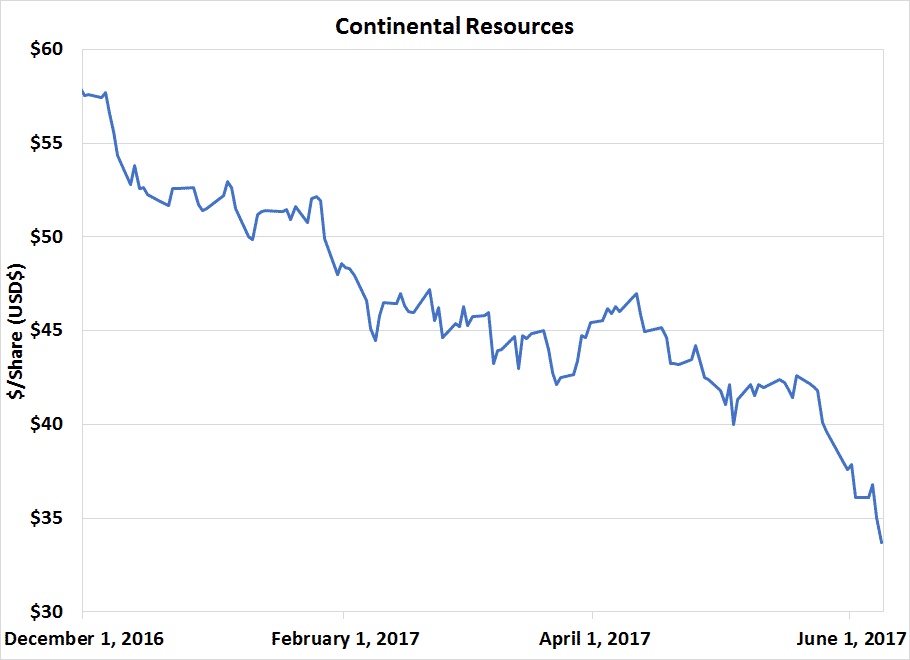

Below is a chart that shows a plunging Continental Resources share price:

If oil continues the decline it started in February – which I think is likely because supplies are plentiful – oil and gas stocks could suffer a big wipeout in the coming months. This would give us the opportunity to buy top-shelf oil and gas assets at fire sale prices. We’re patiently watching this situation unfold. More on this to come.

How Exponential Progress Crushed Oil Investors

***One of the big “running themes” in my market analysis is exponential progress. Driven by huge increases in computing power, technology is advancing at an exponential rate. This not only means that conventional change is occurring… but the rate at which it is occurring is speeding up. (Read my full analysis here).

This isn’t just an issue for tech investors. Every great resource investor is paying attention to this development. Rapid advances in technology can help you get rich or help you get poor.

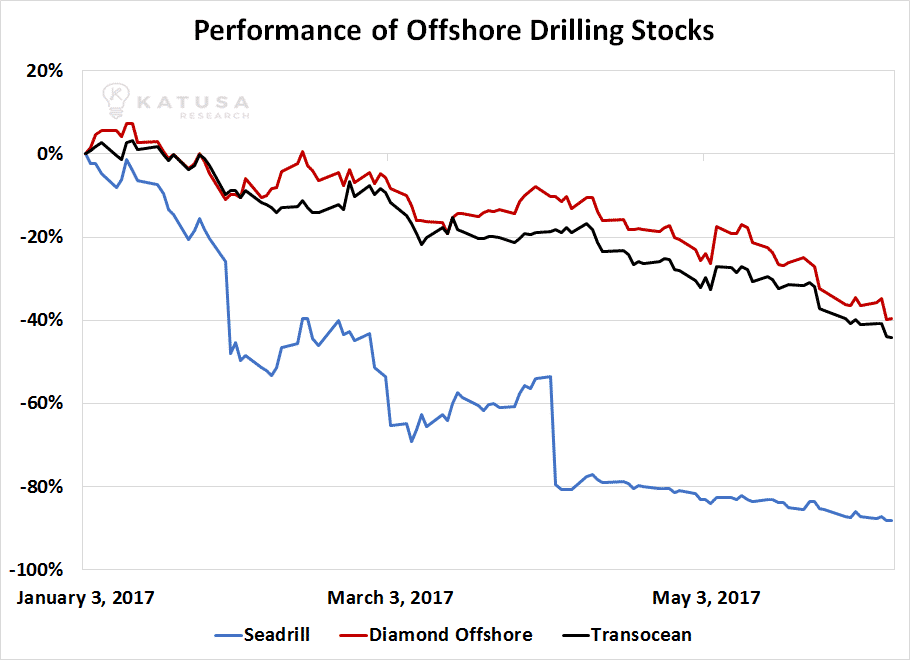

The past few months have brought an incredible demonstration of how this works. Advancements in fracking have increased on-shore oil production so much that offshore projects are getting delayed or simply canceled. This technology-created bear market in offshore drilling projects is destroying the profits and share prices of offshore drill rig operators.

For example, the chart below shows the past year’s performance of three large offshore drillers, Seadrill, Diamond Offshore, and Transocean. They’re getting killed.

Again, resource investors ignore exponential technological progress at their peril.

***One last thing this week if you didn’t catch it on my Twitter account…

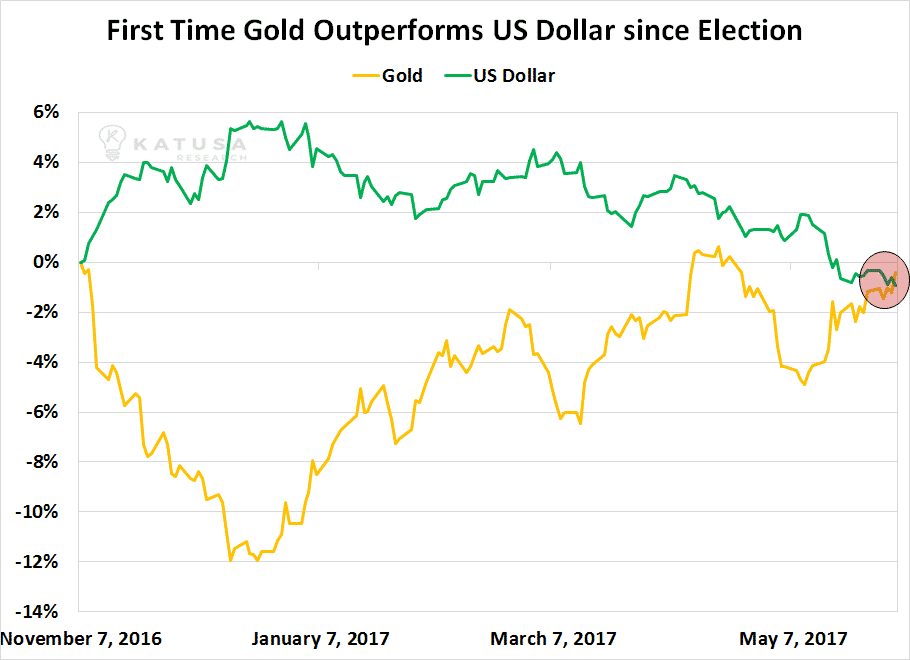

In the wake of Donald Trump’s election win, the U.S. dollar soared and gold crashed. Investors believed Trump would “make America great again,” revive the U.S. economy, and boost the attractiveness of the dollar.

Not to my surprise, Trump is finding it difficult to get anything done amidst Washington DC’s “swamp creatures” – the lobbyists, the cronies, the unions, the arms makers, the bankers, the mooches, etc. The dollar’s post-election rally has fizzled… and gold’s correction has reversed. Gold – my favorite way to Trump-Proof a portfolio – is outperforming the dollar since the election.

Regards,

Marin