November.

For some folks, it means time to hang up the Thanksgiving decorations. For others, it means heading south to a warm place like Florida.

But for me – and every good natural resource investor I know – November means bargain season. It means Christmas comes early… and the presents can lead to hundreds of thousands – even millions – of dollars in extra profit.

That’s because November is the start of tax loss season.

Around this time – with the year’s end in view – investors and speculators start looking at their portfolios and create plans reduce their tax bills. Often, this planning means holding positions a bit longer so they qualify for lower, long-term gain tax treatments.

But for a large number of people, it means deciding to sell stocks based on their tax implications… and not based on their underlying values or abilities to produce cash flows.

If you’ve read my work for a while, those words should interest you. You know that most of the time, the market correctly values most assets. But not all the time.

As investors, we find our edge during those rare times when buying and selling decisions are made not based on values, dividends, or cash flows, but on external factors like fund redemptions, tax considerations, or fears the world is about to end. These periods are when prices decouple from values.

In other words, when selling decisions are based on factors that have little to do with underlying values, we – the alligators lying patiently in the water – can strike and pick up assets for bargain prices.

This is exactly what happens at the end of the year in the natural resource market. Investors dump stocks simply to lock in losses or gains because their upcoming tax bill is first and foremost in their minds. That’s why November through December is known as “tax loss season” in the resource market. This is also the time of the year when fund managers like to push the reset button by selling positions that didn’t work out for them during the year.

Taken together, tax loss selling and large fund selling can produce enormous selling pressure on stocks that haven’t done well in a given year. This selling pushes stock prices lower… which can trigger stop losses and create more selling… which can create a self-reinforcing liquidation cycle that climaxes in a final “puke out.” This can be an incredible time to buy high-quality assets for dimes on the dollar.

Below is a table which shows the annual returns of 15 commodities for each year going back to 2012.

After looking at the table for a few seconds, one of my major takeaways is that the commodity sector has experienced massive volatility over the past five years.

But as I have stated many times in the past, a wise speculator makes volatility his ally. Read my full educational piece on this subject right here.

Volatility combined with tax loss selling attracts experienced and wise speculators to the commodity sector, and they buy the best stocks within each sector that are on “sale”.

To truly take advantage of tax loss selling, you need to know what you are looking for. Do not buy a basket of stocks within a sector just because the commodity is down. Only buy the best stocks in the sector, and make sure you know how to differentiate between average and the best. Let me explain what I do…

The Katusa Tax Loss Strategy

I am going to use the coal sector as an example, but you’ll find potential tax loss selling candidates in every corner of the commodities sector.

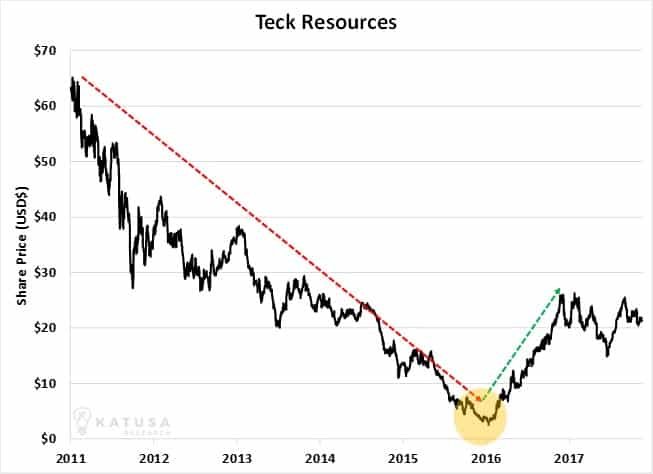

In 2015, coal and copper stocks experienced their biggest losses in decades. Shares in Teck Resources, Canada’s largest diversified miner, lost 72% of their value in 2015, and then in 2016, the share price popped 615%. This is not a junior, this is the world’s second-largest producer of metallurgical coal and Canada’s largest diversified miner. The chart below shows the share price volatility of Teck over the last seven years.

Why the big pop in 2016?

Metallurgical coal prices rebounded 125%, and as a major producer of coal, Teck had an incredible run from a low of $2.66 per share to a high of $25.96 per share.

Yes, smaller coal stocks also rebounded, but Teck Resources is one of the world’s biggest producers. That means its stock is very liquid, which is critical to the success of this strategy. Most juniors in the resource sector are very illiquid, meaning they do not trade millions of dollars of stock per day.

Very little buying can take an illiquid stock significantly higher. But the inverse is also true. Very little selling can slaughter its share price.

But, if you are looking for a tax loss victim, why not buy one that is very liquid so you will be able to sell very quickly without hurting the share price?

Teck is a perfect candidate for this example. Not only did the stock perform as well or better than any other junior coal stock, its liquidity was 10-100 times greater than the juniors.

Remember, tax loss selling happens in all corners of the market, juniors, mid-tiers and the big producers. So, if you are buying for a specific reason, make sure you plan on how you will sell your shares in advance of your buying. Not only do you need a buying strategy in advance, but you also need a selling strategy in advance of your buying. It won’t always work out as you plan, but it helps.

Going back to the Teck example…

If you wanted to participate in the selloff in coal and play the rebound in metallurgical coal prices if you bought a junior thinking it was cheap (which it probably was), the illiquidity of the junior most likely reduced the exit price you would have received. Whereas owning a liquid stock, you would have sold your shares without putting any pressure on the stock.

Here’s how to build your own tax loss season fire sale watch list.

1. Identify the complete list of exploration, development and production stories within the sector.

2. Meticulously comb through financial and production data for every company to identify your targets and the market liquidity of each stock.

3. Meet and discuss the company’s 2018 outlook with the management team. Are there positive catalysts on the horizon to drive the share price higher?

4. Execute your ideas during tax loss.

Does this sound like a lot of work?

It should, because it is.

You can spend thousands of hours of your time, or you can piggyback on my hard work. Not to sound cocky, but ask anyone who knows me well in the sector and ask them if I am one of the hardest workers and sharpest in the sector.

I have already calculated my own propriety metrics and ratios to identify the best tax loss candidates at the exploration, development, and production stages.

I have a shopping list of companies with very high-quality assets that have not done well in 2017 for various reasons. They are prime targets for tax loss selling and selling from impatient shareholders.

I’m looking for the market values of these companies to become decoupled from my estimate of their intrinsic values… the values knowledgeable industry players would happily pay for the companies.

On Dec 6th, 2017 I will publish my Tax Loss Hit List in Katusa’s Resource Opportunities.

Or, you can spend a thousand hours doing homework and compete against me. I know who I am betting on.

Regards,

Marin