Just this past week, gold prices hit all-time highs in most major currencies.

The British Pound… the Canadian Dollar… the Australian Dollar… the Indian Rupee… the Japanese Yen… the Chinese Yuan… the South African Rand… and more.

It also broke above $1,500 in dollar terms. The highest it’s been in 6 years.

This shouldn’t come as a total surprise…a trade war between global economic powers, global debt spiraling out of control…

Iran and North Korea building up weapons…

The world is in uncharted waters.

Are the chickens going to come home to roost?

Today I’ll share a few of the major key themes that every investor needs to be aware of right now.

The Chinese Yuan is in Freefall

Given the recent onslaught of tweets from Donald Trump, you’d think the Chinese Yuan had just started falling.

In reality though, the Yuan has been depreciating since 2014.

This trend was further magnified when the Chinese government let the Yuan fall below its symbolic threshold of 7 Yuan per U.S. dollar.

When this happened, the #POTUS tweeting machine went out in full force, labeling China a currency manipulator.

Below is a chart which shows the historical exchange rate between the Yuan and the U.S. dollar.

Currency devaluation aside, it makes a lot of sense to own assets which hold their value.

Physical assets like gold, art and vintage wine all make for excellent hedges against currency devaluation.

But it’s tough for major institutions or governments to buy enough art or wine to truly protect themselves. This leaves gold as the number one acquisition.

It should come as no surprise that central banks have been very active in buying gold.

Especially China’s…

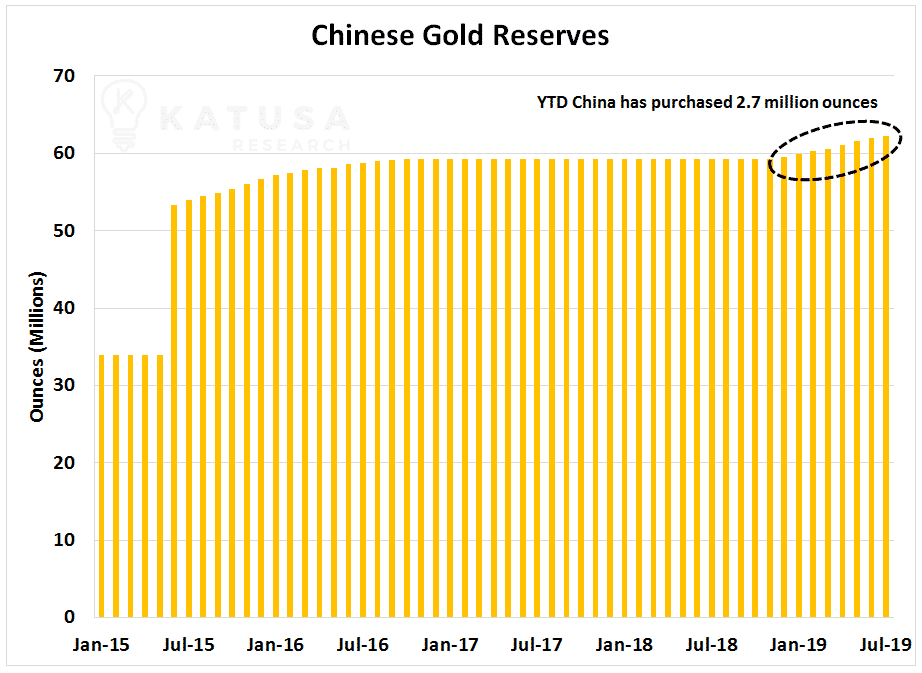

The Chinese Central Banks are Buying TONS of Gold

And I mean that literally.

- Just so far this year, the Chinese have acquired 2.7 million ounces (92.5 tons) of gold. Using a spot price of $1,500, that’s $4 billion worth of bullion.

Below is a chart showing Chinese Gold Reserves.

The U.S.-China trade war has not only impacted the American and Chinese economies, but the entire pattern for global trade as well.

Leading global economic indicators like national Purchasing Manufacturing Indexes have only recently begun to nosedive. And this could easily be just the tip of the iceberg.

To make matters worse, it’s getting harder and harder to find somewhere safe to park cash.

In times of chaos, government bonds are usually a standard go-to investment.

However, times are changing.

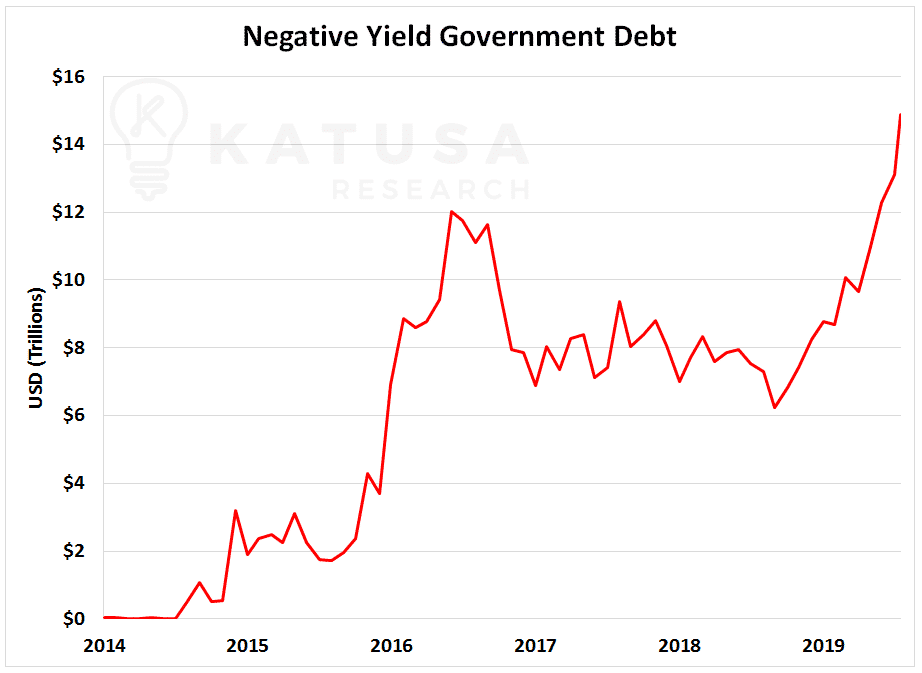

Right now, many government bonds actually have a negative yield – something I’ve talked about recently.

You read that right – if you invest $100 into negative yield or a government bond in almost any European nation, you’re going to get back less than $100 in 10 years’ time.

How crazy is that?

Below is a table which shows the current yields on government bonds in nations around the world. The darker the red, the more negative the yield.

I believe there’s more devaluation to come.

Below is a chart which shows the soaring amount of negative yield government debt. It has recently surpassed $15 trillion.

Just a few years ago there was virtually none. Below is a chart showing this dramatic increase.

That’s when investors look to the famous “pet rock” and “barbarous relic” for some wealth protection.

After all, it’s that or slowly lighting your money on fire buying bonds in countries with negative interest rates.

With bond yields the least attractive they’ve been in years, investors and central banks are turning to gold.

And with the recent surge in the Commitment of Traders long positioning and the price of gold smashing through $1,500… many pundits are saying “THIS IS IT!”

To be honest, I couldn’t care less what the talking heads say their target price is.

From a fundamental perspective gold is very strong right now.

With nearly two decades of experience managing a fund focused on the commodity sector… I know that being positioned in the best gold developers and gold producers offers tremendous leverage to rising gold prices.

- My subscribers and I are up over 100% on one of my strongest conviction investments so far this year.

Many of our other positions are up over 50% so far this year. The Katusa’s Resource Opportunities portfolio is incredibly well positioned to profit from the global market chaos.

And in the coming weeks I will be publishing a brand new gold recommendation to my subscribers. It’s going to be the hottest gold deal of the year. Because with the last company the architect behind this story built… investors made ten times their money.

The unrest in China, the trade war and the rise of negative yield debt aren’t likely to be cleanly resolved anytime soon.

And in the meantime, many will flock to the safest haven they know – gold.

Regards,

Marin