Earlier this week, Newmont Mining (NEM) rocked the gold world when it announced its $10 billion purchase of Goldcorp (GG).

The all share deal will give each Goldcorp shareholder nearly a 1/3 share of Newmont.

Not having much to cheer about, Goldcorp shareholders (I didn’t own any) will be happy to take the 17% premium. But it’s a better deal for shareholders than the rumored Newcrest Mining deal. It was offered to the board of Goldcorp at no premium just before Christmas.

When this deal is complete, Newmont/Goldcorp will be the largest producing gold company in the world. It will pump out between 6 and 7 million ounces of gold every single year for at least a decade.

Newmont will also strengthen its balance sheet through operational efficiencies which could add up to $100 million and noncore dispositions that will occur post merger (shares in juniors, non-core assets, etc).

Newmont is Preparing for the Next Bull Market in Gold

This isn’t a short sighted move by the aptly named Gary Goldberg, CEO of Newmont.

Newmont recognizes the core value of Goldcorp’s flagship assets. No question Goldcorp made some missteps and there will be a lot cut from the combined entity in the next 24 months. But when the gold price rises in the next gold bull market, this could look like a genius purchase.

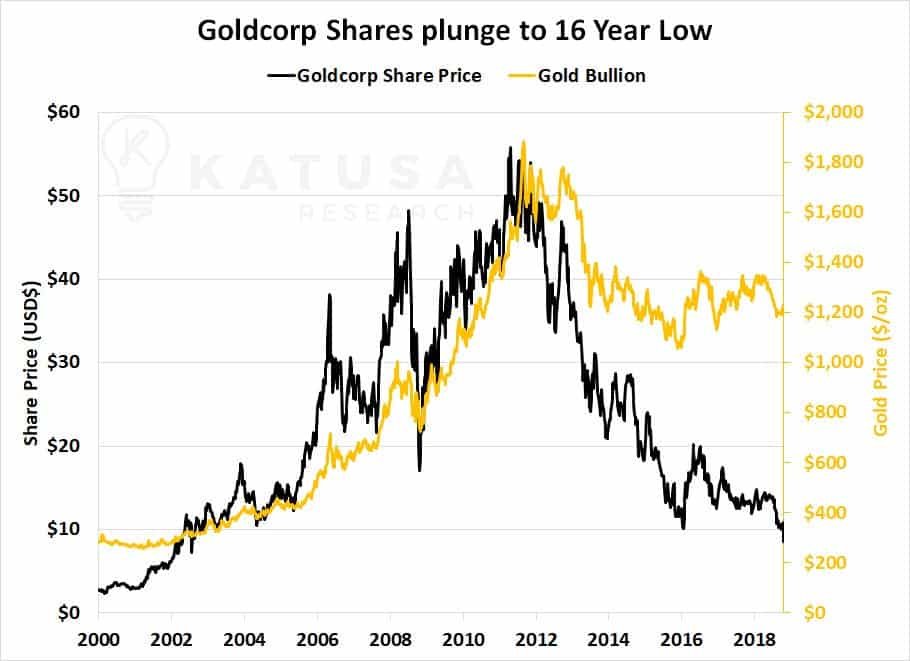

Shares of Goldcorp got slaughtered since 2011. Take a look at this multi decade low in late 2018…

What This Means for Junior Gold Stocks

For one thing, this acquisition of Goldcorp will be a slow and drawn out corporate process. People will be let go and projects will be shelved and sold.

But what does it mean for junior gold speculators? The two recent mega mergers will limit investments into juniors by the majors and takeovers, as the big two (Barrick 2.0 and Newmont) execute their synergies and divestitures.

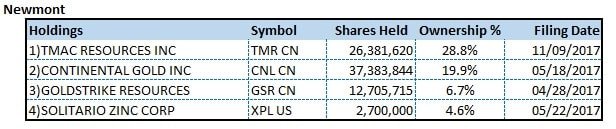

In the table below, let’s take a look at the significant stakes in smaller gold companies that Newmont currently owns.

Never Fear – When Gold is Near

Anyone with an internet connection these days knows how strong the U.S. stock market has been over the last 9 years.

Cheap money fueled an exceptional rally that drove indexes to new highs.

But financial heroine (cheap money) only can last for so long. And when the junkies can’t get their fix, look out.

The financial withdrawal that the global markets will experience will be unlike anything ever experienced. Just like junkies, the previous dose won’t get the same high. And the debt levels are near O.D. (overdose).

In December 2018, there was a mass exodus of capital from the major U.S. indexes. Selling pressure was fierce and led to the first negative year for the S&P 500 since 2011.

I have long said that gold and gold stocks should make up a portion of one’s investment portfolio. Especially during periods of economic uncertainty.

President Trump shut down the government over a fight about building a border wall in Mexico (power politics at play). Meanwhile, he’s also in the middle of a trade war with China.

The markets are uncertain. Gold is certain. Gold has lasted thousands of years and will last another thousand.

Below is a chart which shows the historical returns for gold and the S&P 500. You’ll see that in all the major corrections over the last 20 years, gold has been a strong performer.

Look no further than historical corrections in the S&P500 to see how gold can act as a hedge:

Gold’s Mojo is Rising

I’ll be the first to admit, gold has been a lousy sector to invest in over the past 5 years.

Even with massive ten baggers on Northern Dynasty and Newmarket Gold (which became Kirkland Lake), its been a market that has tested my own testicular fortitude. And Patience. My big bet on Nevsun Resources played out well. But I’ve had some smaller bets that haven’t worked out and I cut my losses and moved on.

Out of the hundreds of data sets we track for precious metals including mine reserves, commitment of trader reports and others…

We are big fans of looking at sentiment.

We want to know who’s talking about gold and how they’re talking about it. And we have just the tools to tell us.

Right now, our sentiment indicators are flashing a massive green light. It’s showing an upwards spike in gold sentiment.

In fact, over the last month positive mentions for “gold” and “gold stocks” have achieved a 65% increase over the month previous.

This coincides with a rising gold price and the price of gold equities.

Gold stocks could just be the #1 investment of 2019. And a prudent investor or speculator needs to be positioned accordingly.

Here’s How We’re Preparing for a Golden Bull Market

Long-time readers know I’m a big fan of holding some physical gold and even silver.

But there’s a much, much better way to profit off a rising gold price. And that’s by holding underlying gold equities.

And with the recent $10 billion takeover of Goldcorp by Newmont, it sets the stage for a massive shakeup of efficiency in the industry. The best will get better and this news will spark massive interest in what’s next.

I’ve got in-depth research on every publicly traded gold producer in the world. It doesn’t give me a crystal ball but it narrows the field big time.

I have an extensive rolodex with the best management teams in the business. Proven teams that have discovered, developed and operated world class operations.

With gold spending much of 2018 under the radar thanks to Bitcoin and Marijuana, its recent move is getting attention. The time to pick up gold stocks is before they make their next 50%, 100% or 300% move in short order.

That’s when a much wider audience will look to jump in. Volumes will swell, traders will come in and you’ll see gold newsletters coming out of every corner.

But there’s still a window to scoop up the best of the best gold companies before that happens.

And that’s exactly what I’m doing with millions of dollars of my own money.

I am buying world class assets, in the top jurisdictions, with the best management teams.

If we’re at the start of a major rally in gold, look out.

In the February issue of Katusa’s Resource Opportunities, I am publishing the details of two gold companies I believe will be bought out in 2019. And what price to buy those two companies.

I plan on having myself and subscribers positioned to profit, so make sure you are too. And I will be putting even more money into select companies over the coming months.

So stay tuned.

Regards,

Marin