Beware the BBQ Pitch: Counter Indicators to Avoid Losing Money

You can spot the pitch from a mile away, and there are 3 indicators to watch for.

Tightening the Taps: A Macro-Economic Update

Step back and watch the confusion in the heart of the U.S. monetary system.

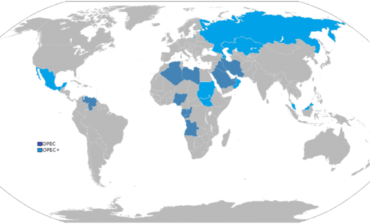

Chile’s Shot Heard ‘Round the World

Chile’s sudden, unthinkable move is sending massive shockwaves throughout the lithium industry. It threatens to decimate the entire EV and battery markets.

America’s Third Energy Revolution

Hold onto your hats, we're living through a rare, history-making moment.

White Gold Mines and Wild Rides

Don't be deceived. This rollercoaster is gearing up for another thrilling climb, and you'll want to grab a seat.

The “Paper Gold” Markets

The idea behind the paper gold market is to make it easier for people to invest in gold without the hassle of storing or securing physical gold.

Central Bank Signals and The Secret Behind the GDXJ

You’ll see the strategies on how Central Bank actions influence the world's gold market. And we’ll reveal something you might not know about the GDXJ.