The year is 2013, and the German central bank, Deutsche Bundesbank, unveils its daring plan.It will repatriate 21.67 million ounces of its gold reserves from foreign vaults in New York, London, and Paris.This courageous move captures the world’s attention, raising eyebrows and igniting debates.What triggered this decision? What does it mean for the global economy?As Germany embarks on this mission, it sends a powerful message about the significance of gold and the need to protect national assets.Over the course of four years, the Bundesbank successfully completed the repatriation, bringing more than HALF of Germany’s gold reserves back to its homeland.This remarkable feat demonstrated the importance of physical possession of gold reserves for central banks and governments in an increasingly uncertain world.

- But what does this mean for the global gold market today?

- And what’s the secret behind the Gold Junior ETF, GDXJ?

This week, we’ll explore the role of central banks as the primary buyers of gold.You’ll see the strategies these financial institutions employ to secure their nations’ wealth and learn how their actions influence the world’s gold market.And we’ll reveal something you might not know about the GDXJ.Let’s get into it…

Central Banks Are Hungry for Gold

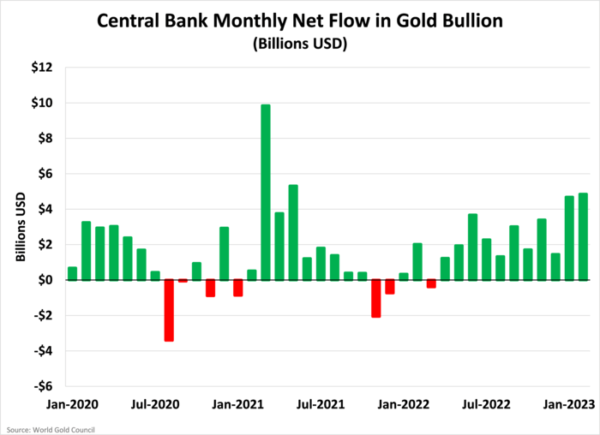

Central banks have been making noise in the markets, and are one of the primary buyers of gold in the last few years.Here’s a chart that shows the monthly “net flow” of gold purchases and dispositions by central banks around the world since Jan 2020.

Only a handful of times have central banks as a group been net sellers and this is because they’re not opportunistic traders. Central banks buy gold as part of a nation’s financial reserve strategy.Looking at this on a cumulative basis since 2020, central banks around the world have added a lot of gold to their reserves.In total, they have bought almost 38 million ounces of gold, which is worth about $76 billion.You’ve likely heard me talk about the importance of fund flow.Measuring fund flow is done through analysis of Exchange Traded Funds creation and redemption patterns.

- When investors are bullish, there is more demand for units than available for sale, so the ETF creates new units.

- The opposite happens when investors are bearish.

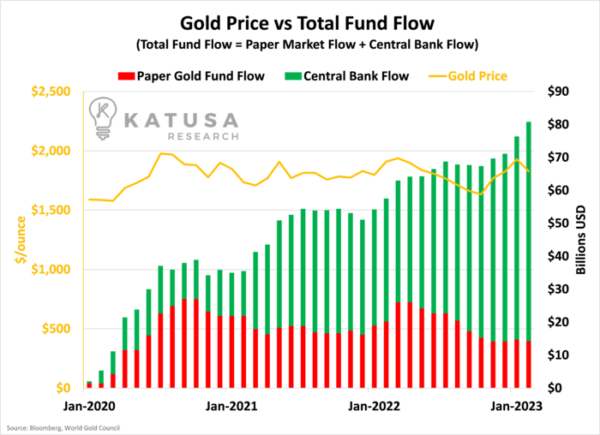

This can be done for any set of ETFs and I use it as a key metric for gold.Below is a chart which layers central bank and paper gold fund flow into a single chart that shows the cumulative flows relative to the gold price.

This chart makes it crystal clear.

- ETFs have actually been net sellers for the past year.

- The central banks have been driving the gold price higher, not the paper gold market.

Who are the Largest Buyers of Gold?

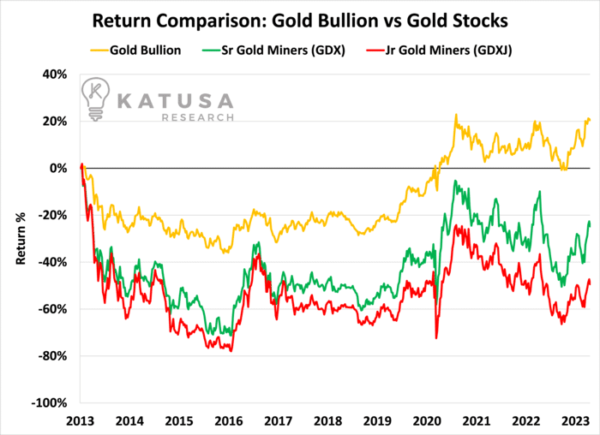

So far in 2023, Russia (1 million ounces), Turkey (1.46 million ounces), China (1.28 million ounces) and Singapore (1.65 million ounces) have accumulated the most gold.Now with the understanding that central banks have been driving the gold price higher, rather than the paper gold investors, it is time to see how gold stocks are reacting.Central banks cannot buy gold stocks, so investors need to lead the charge if there is going to be one.The chart below tells us that if you bought a group of gold mining companies and kept it for the last 10 years, even though gold prices have gone up by 20%, you’d actually be majorly underperforming and likely down 50% on your money.

The Secret Behind the “Gold Junior” ETF

Staying focused on the chart above, and as we explained many years ago—the term GDXJ (Gold Juniors Fund) is a misnomer.GDXJ is an acronym for the “VanEck Vectors Junior Gold Miners ETF”, which is a fund that tracks the performance of smaller, so-called “junior” companies that are involved in gold mining.It’s a misnomer because companies like Pan American (2nd largest pure silver producer in the world with an MCAP of $8B) and Kinross (multi-million-ounce gold producer with an MCAP of $8B) are in the GDXJ and make 12% of the GDXJ.There are few “juniors” in the GDXJ, and that is sole because the liquidity was so low the selling pressure from GDXJ rebalancing would crush the stocks and hurt the GDXJ index performance.

The Gold Niche

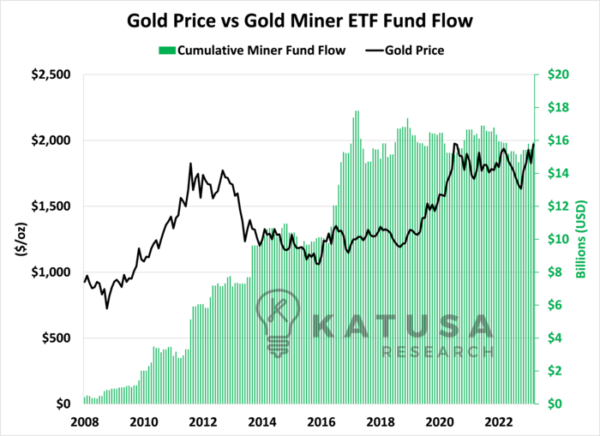

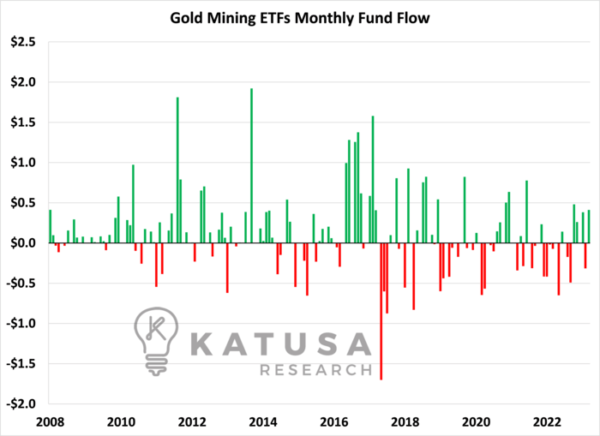

Gold stocks are a niche and speculative sector, that requires testicular fortitude and precision timing. One of the major keys to success as a speculative investor in mining stocks is timing the window.You need to get in cheap and take profits when volumes and generalist fund flow are in your favor.Below is a chart that shows the fund flow across gold miner ETFs. Like the chart further up:

- Bullish investor behavior is represented by green bars caused by ETF demand greater than redemptions, and

- Bearish months where redemptions outweighed creations in red.

Once again, monthly activity only tells one part of the picture. Seeing the fund flow cumulatively, relative to the gold price is more helpful. Below is a chart which plots cumulative ETF miner fund flow versus gold.

- This chart is even more concerning. Since 2016, there has essentially been no new money entering these ETFs.

Why can I make that statement?Because since that time, fund flow has remained unchanged.Buyers have mostly been equal to sellers, which means net fund flow is close to zero, and thus there’s been no new money coming into the gold miners to tip the scales.I’ve said it before, that in order for there to be a true bull market, capital must come from outside the sector.Or else it is just one current investor, selling to another current investor and the net change is zero.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.