As you read this, the calendar is halfway into November.

For some folks, this means heading south to a warm place like Florida. For some, it means breaking out the winter coats and hats.

For top resource investors, it means tax loss selling bargain season.

It means Christmas comes early…and the presents can lead to hundreds of thousands – even millions – of dollars in extra profit.

At the end of the year, investors and speculators start looking at their portfolios and formulating plans to reduce their tax bills.

This means deciding if positions should be held to get short-term gain tax treatment or long-term gain tax treatment.

But more often than not, it means deciding to sell stocks based on factors that have little to do with their underlying values.

If you’ve read my work for a while, those words should trigger your interest. You know that most of the time, the market places the correct value on assets. But not all the time.

As investors, we find our edge during those rare times when buying and selling decisions are not made based on values, dividends, or cash flows. But instead on external factors like fund redemptions, tax considerations, or fear the world is about to end.

These periods are one of the only times that values seriously decouple from prices.

In other words, when selling decisions are based on factors that have little to do with underlying values, we – the patient alligators – can strike and pick up assets for bargain prices.

This is exactly what happens at the end of a brutal resource year like the one in 2018 in the resource market.

Investors dump stocks simply to lock in losses or gains because their upcoming tax bill is first and foremost in their minds.

That’s why the next seven weeks are called “tax loss season” in the global markets.

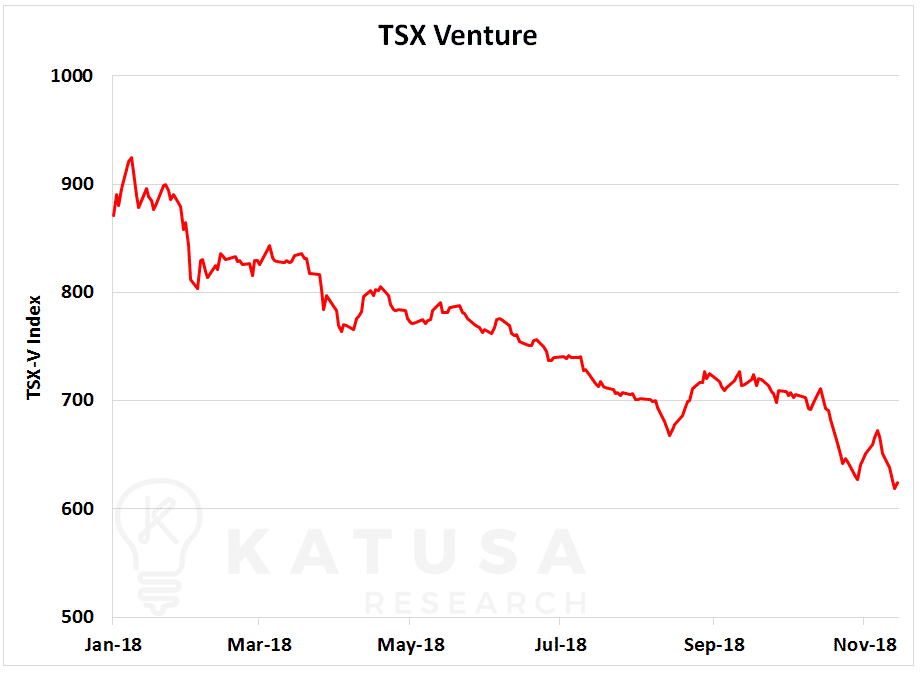

I think this tax loss season will be particularly painful for some stocks. This has been a brutal year for venture type stocks. Take a look at the YTD performance of the venture heavy TSX-V:

The TSX-V is down 29% for the year. And this includes many crypto, cannabis, resource explorers and other tech ventures plays that are down even more. Especially for those HODLers.

That is why I believe certain companies will experience extra selling pressure, which means lower share prices. Simply because those who have locked in gains on certain stocks over the last year (crypto in January or Cannabis in September) will be extra diligent to lock in losses elsewhere in order to lower their tax bill.

Losses in cannabis, crypto, precious metals and resources alike could spell an ugly tax loss season. If this materializes it could spell opportunity if you choose right.

Do you know which gold producers have a Katusa – All-in Sustaining Cost of gold under the spot price of gold? That means you include their AISC and all general & administrative costs on top. I.e. the REAL costs.

We do.

Do you know which energy companies are making money at $25/lb uranium or oil prices at $55/barrel or lower?

We do.

These are just some of the data we monitor every day, hunting for the best world-class projects on sale. (Note: Keep your eyes here and in your inbox for a very special 360 degree series I will publish very soon on uranium).

Will Tax Loss Selling Hit the Gold Sector in 2018?

Yes.

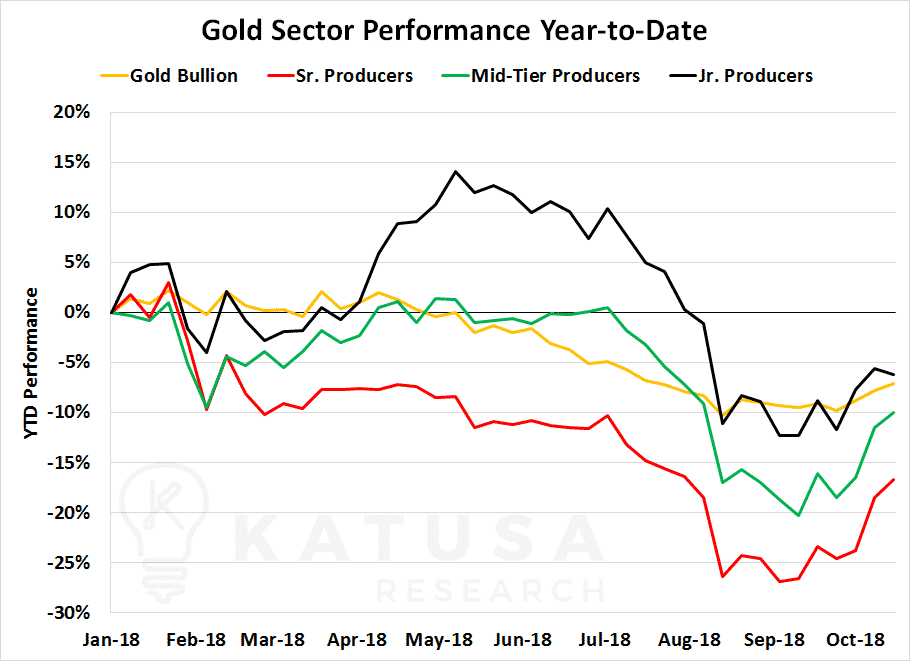

Below is a chart which shows the performance of gold bullion along with senior, mid-tier and junior gold producers. Surprisingly, the seniors are leading the charge down. This is a telling sign of where institutional and passive fund money is going.

Unquestionably, it’s been an ugly year for gold stocks. And this group are prime candidates for tax loss selling. Investors will want to rid their portfolio of the have nots and put more money into the have’s.

And the last 90 days have been truly terrible in the gold markets.

Earlier this year in an edition of my premium research service, Katusa’s Resource Opportunities, I wrote:

The senior producers, which you would think are the safe, stable businesses, are actually the worst performers – down nearly 30% year to date and likely to continue their downtrend during tax loss season. Barring a substantial move in the gold price, I think gold producers are going to be under serious pressure for the remainder of the year.

Tax loss season is around the corner, and I think many investors who own these “safe and stable” large producer names will be hitting the bid. Assuming I’m right, this should provide a great setup for getting into many de-risked companies after the washout.

Lo and behold that prediction came to light for alligators thinking of pouncing.

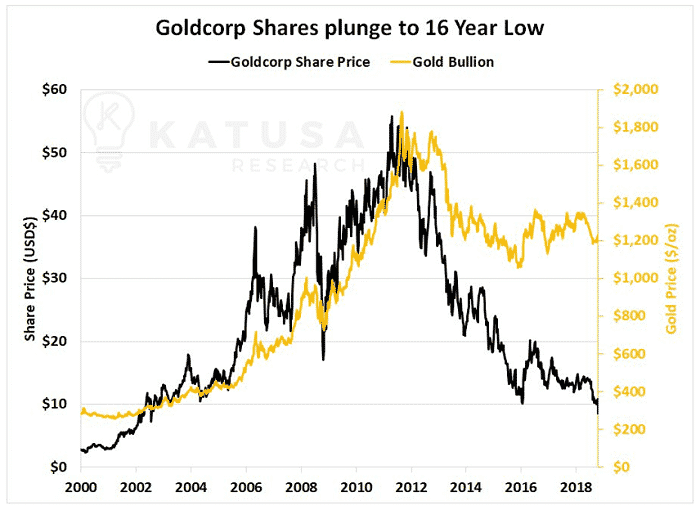

In late October, Goldcorp, which is one of the world’s top 5 producers of gold, was trading at its lowest level in 16 years.

Think about how hated the gold sector is becoming.

The last time Goldcorp (GG:NASDAQ) traded below $9 was in 2002. This was back when gold was trading for under $300 an ounce!

The Real Boxing Day Bargains

Though tax loss selling comes around every year, this season’s opportunities may prove to be particularly juicy for investors.

However, stocks that are already under pressure now may not be out of the woods yet.

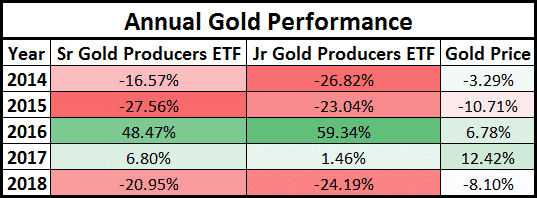

Had you been an alligator in the 2015 tax season, 2016 treated you very well.

Companies with proven, low-cost deposits in safe jurisdictions, led by strong management teams are the kind of companies that we look out for at Katusa Research.

And of course, this applies across the entire resource sector – not just gold.

Tax loss season may be prime time for building portfolio positions, but that doesn’t mean you get to skip your due diligence. You still have to find the right companies to buy.

A discount means nothing if the product you’re buying is still worth less than what you’re paying for it.

But luckily for our Katusa’s Resource Opportunities subscribers, we’ve already done all of the leg work for them.

We are constantly filtering through companies in the resource sector, updating and reassessing valuations, in order to find out which companies are worth their share price.

And at the end of the year, when tax loss selling is in full swing, my readers will know which companies they should be looking out for – and what the right price to pay for them is.

I will be announcing my number one tax loss candidate for 2018 on December 5th, in the next edition of Katusa’s Resource Opportunities. Do yourself a favor and let the best show you how it’s done.

Do it. Just do it.

Regards,

Marin Katusa