On June 29, 2007, Apple released its now-iconic iPhone for sale in the United States.

In the years that followed, Apple sold over 700 million iPhones, dominated the smartphone market, and became the world’s most valuable company.

Around the time Apple rolled out the iPhone, Netflix rolled out its streaming movie service.

In the years that followed, streaming became a phenomenon. More than 60 million subscribers signed up for the service. Demand was so high that at times, streaming represented more than 35% of Internet traffic. Netflix shares climbed more than 3,200%.

There’s another side to these success stories. There’s always a loser choking on the dust of a winner. Apple’s iPhone became a huge hit at the expense of the then-popular BlackBerry phone. The maker of BlackBerry, Research in Motion, suffered a spectacular collapse.

The rise of Netflix meant the demise of brick-and-mortar movie rental giant Blockbuster. Blockbuster fell behind the times and filed for bankruptcy in 2010.

These stories are extremely important for resource investors right now. The success of another innovator, Tesla Motors, has raised some big questions…

“Will electric cars eventually make oil worthless? Will they kill ‘Big Oil?’”

The answer has major economic implications; it has major investment implications. After all, if electric cars explode in popularity, most oil investments will be huge losers. Your shares of ExxonMobil or Chevron could plummet in value. Trillions of dollars of oil deposits could take a 90%+ haircut in value.

In this essay, I’ll answer the big electric car question…and tell you how to invest in what’s coming…

Why This Question is Finally Relevant

The threat of electric cars is nothing new for the oil industry.

People have claimed electricity would replace gasoline for a long time… and they’ve been wrong for a long time. The reason why is simple economics. The cost of building electric cars and a grid to fuel them was astronomical compared to the cost of sticking with the status quo.

But over the past 10 years, electric car technology has radically improved. Battery technology has radically improved. Power efficiency has radically improved.

And performance? The Tesla Roadster can go from 0 – 60 mph as fast or faster than any comparable gasoline-fueled sedan. The Tesla Model S was named Motor Trend’s Car of the Year in 2013, beating Porsche and BMW products.

Meanwhile, electric vehicle costs are plummeting. Batteries make up about a third of the cost of an electric vehicle. They’ve dropped in price by about 60% in the past five years. They’re expected to drop another 55% in the next 10 years–and that is a conservative estimate. In reality, costs will drop much more, much faster.

So the EV revolution is real. The EV sector is going to get a lot larger.

And it’s not just Tesla. Volkswagen, GM, Ford, BMW, and many non-motor companies like Google and Apple are entering the sector in a big way.

With all these companies investing in EVs, the technology will continue to improve. But will it kill the need for oil? Will it make oil investments losers?

The answer is “NO.”

In 2016, over 95 million barrels of oil will be consumed every day.

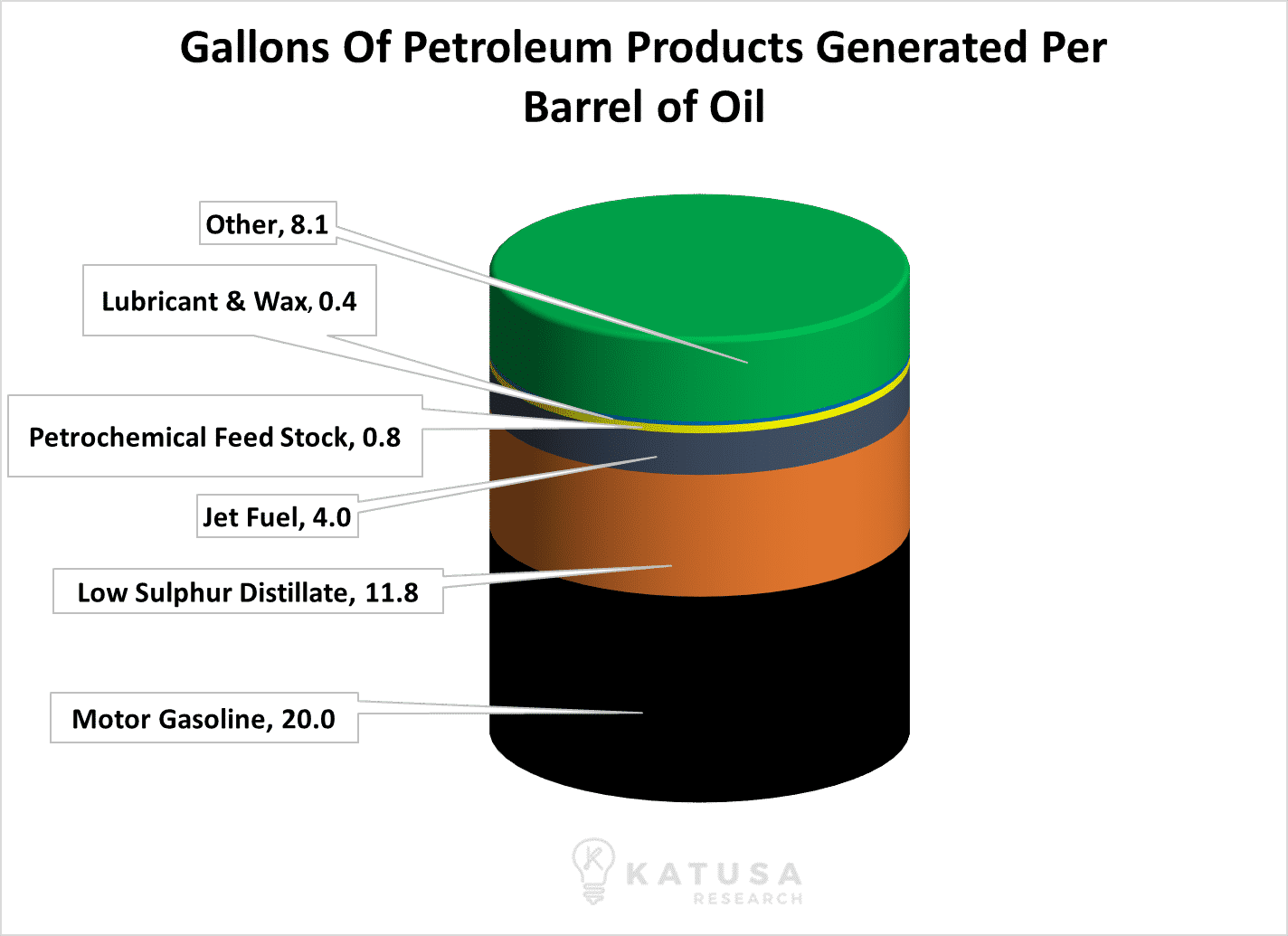

Gasoline used in motor vehicles is the largest consumer of that oil; approximately 44.4% of every barrel is used to make gasoline.

Many people suggest that oil demand has peaked, but I think it’s quite the opposite.

Forecasters fail to remember that outside of North America and Europe, most societies are relatively poor…but growing rapidly. Economic growth rates in the “BRICS” (Brazil, Russia, India, China, South Africa) countries are double those of the developed world. These expanding economies will drive massive demand for gasoline powered cars, trucks, planes, and boats. They will demand huge quantities of oil. The chart below shows how demand from emerging markets (in green) is steadily rising, while demand from developed markets is slowly declining (blue line).

Oil demand in the developed world (OECD in the chart) hasn’t changed much in the past 20 years, but demand in the developing world (Non-OECD) has nearly doubled over the same time period. We can expect this trend to continue. Blue collar workers in China and India cannot afford $100,000 Tesla electric vehicles…but they can afford small gas-powered cars that will get them from point A to point B.

The point is that EVs are “still” luxury vehicles in the OECD nations, while gas-powered vehicles have become so cheap that a blue collar worker in China can now afford one. This won’t change for many decades.

In other words, the glass is half full for oil companies, not half empty.

Currently, there are 1.1 billion cars on the road. By 2025, there will be 1.5 billion.

By 2040, it is expected that there will be 2 billion cars on the road.

It’s forecasted that by 2040, EV sales will represent 35% of new car sales. The math works out to approximately 40 million new cars and in total about a quarter of all cars on the road will be electric.

This does represent a changing of the guard, so to speak, but by no means does it indicate that EVs will kill oil.

Why Big Oil Will Survive and Produce Shareholder Returns

Big Oil is about as smart as it gets. After all, that’s why it is Big Oil.

Big Oil executives know the EV is out to get them.

The best way for Big Oil to stick around is to become Big Green… to become diversified energy companies that produce whatever type of energy the world demands, whether it’s oil, natural gas, solar, or wind.

Big Oil will realize it is in the “energy” business…not just the “oil and gas business.”

The 400 million electric vehicles in 2040 have to be powered by something.

Bloomberg forecasts we’ll need 1900TWh of electricity to power all the electric vehicles…that is equivalent to 10% of global electricity consumed in 2015.

This means we will need a lot of new power capacity. Over the long-term, we’ll produce more of that power from solar, wind, geothermal, and nuclear sources. It would be incredibly hypocritical to power electric cars from coal or natural gas generating plants.

Big Green and nuclear will play a much larger role globally over the next 25 years.

In May 2016, one of the world’s largest oil companies, Total SA, made a billion dollar acquisition in the renewable energy space when it acquired Saft. Saft is a French renewable battery manufacturer, one of the largest in the world.

I expect to see Big Oil do a lot more branching out like this…and continue to rack up profits by powering the world.

Not only will the EV not kill oil, but it will also be the catalyst to get Big Oil into the green sector and offer investors even bigger profit opportunities by being ahead of the curve.

Regards,

Marin Katusa

P.S. Big Oil’s investments are just one part of a giant wave of money headed towards the renewable energy sector. One of the biggest spending programs in history is about to make a small group of energy investors very rich. You can profit alongside me over the coming years as a member of Katusa’s Resource Opportunities.