It’s one of the most famous market sayings…

“Buy when there’s blood in the streets.”

Our firm spends hundreds of thousands of dollars on data feeds, subscriptions, and off-market insights.

Not to mention employing a large internal and external team of analysts, consultants, and professionals in almost every field.

But some of the best intuition I get comes from the OMI, “Outside of Market Indicators”.

All my “outside-of-market” indicators have not flashed that we’re in tough or panic-like times, similar to 2008-09 or Spring 2020.

To me, it says that there’s not the proverbial blood out in the main streets yet.

Main Street Health Check

Art Dealers

I visited and spoke at length with one of America’s high-volume art and sculpture dealers at his headquarters.

His firm travels across the continent to road shows, boutiques, and events, many of which you might be familiar with or have heard about.

I’ll keep his name private to hold his identity in confidence.

From what I’m told there’s no slowdown in rare, unique pieces at the high end just yet

- The sales dollar volumes in art and sculptures are among the highest he’s seen through many cycle downturns and slowdowns in 30 years.

Even his sub $2500 pieces are moving near all-time highs.

Now that could all change the longer the market selloff and economic slowdown continue. But it hasn’t, yet.

Luxury Goods

Many people know that I’m a big fan of getting fine wines at a big discount to their intrinsic value.

Anyone who’s had dinner with me knows that I love looking through the wine menu to find gems at under-market value. And it happens.

Especially post Covid, as restaurants have not updated their wine menus and many are using 3-year-old menus.

- I’ve tried to be a hawk at certain wine auctions in the past – and recently prices and volume of bidders in the recent auctions are the highest I’ve ever seen

For example on the high end…

A bottle of the wonderful 2016 Sassicaia, that in 2019 sold for $280, is now bidding prices north of $1200 per bottle (not the case!).

Even a 2012 Caymus Cab Sav, which could be bought for $100 taxes included just a few years ago, touched $450/bottle.

I get the cult following in Screaming Eagle and the bids in the $4000-5000 range per bottle.

But for Caymus and Stags Leap getting 4-5x the 2019 prices? It doesn’t make sense to me.

- It tells me there’s still a lot of cash on the sidelines for high-end and mid-market wines willing to pay for what they like.

It’s not just fine wines…

Auction prices for high-end whiskeys and bourbons are also through the roof.

The market for luxury watches (new and second-hand) continues to be at an all-time high, but is starting to show signs of slowing down.

Houses

I’m lucky enough to live in one of the most “livable” cities in the world, Vancouver. I also look at it as one of the speculative capitals of the world.

Whether it’s for small-cap companies looking for funding…

Or international capital coming from China to offshore their assets to buy homes and inflate prices (especially on higher-end homes and properties).

One of my tell-tale market pain indicators is high-end Shaughnessy homes ($10M+) and vacation properties in Whistler. Both attract major international capital.

Capitulation hasn’t worked through either real estate market yet.

But it will.

Airports

Look around you at the next flight you take. Terminals are packed and airplanes are all full. Is it just overspilling from pre-Covid bookings?

I’m sure a lot of the travel is coming from pre-paid tours from before Covid that are now working their way through the system.

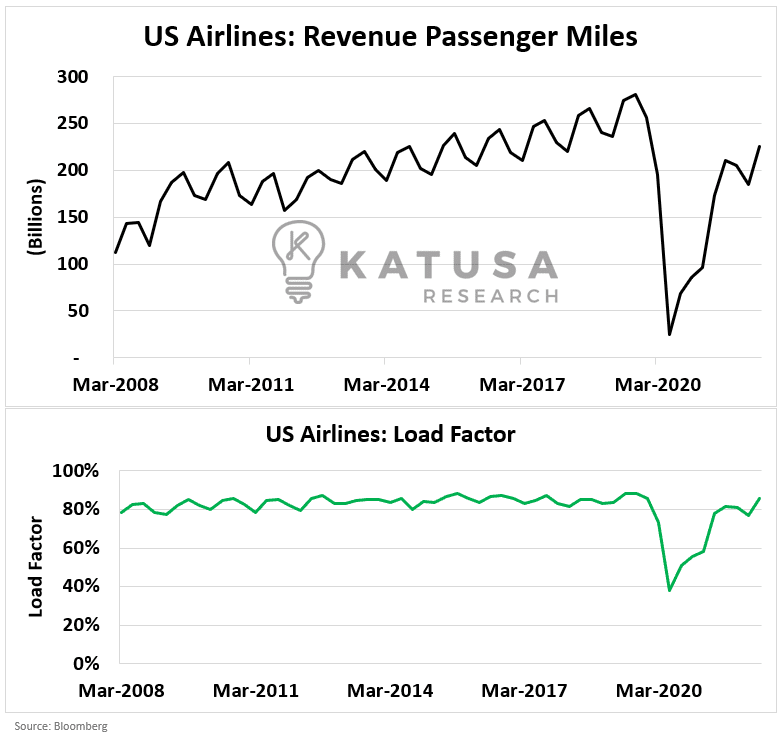

Below is a chart that shows the Revenue Passenger Miles (RPM) for US carriers, and the associated load factor. The RPM is the actual number of seats sold on the plane multiplied by the distance traveled.

You can see load factors are almost back to historical norms, while RPMs are climbing back to highs.

All the while mortgage rates, and home equity lines of credit have shot up in terms of borrowing costs.

Granted, the increase in interest rates hasn’t hit a big proportion of mortgages as they were fixed, but they will during renewal time.

Much of the general population is living paycheck to paycheck and has not felt the pinch that is coming—but they will.

Stress and austerity have not worked its way through most households just yet.

Peak Panic Hasn’t Hit the Markets Yet

A lot of the data and indicators we follow (including these main street ones) haven’t signaled capitulation.

Like in cycles past, major dips in the past have been great buying opportunities.

And to be clear, I expect that again. But not yet, as I see more downward pressure.

I don’t know when that will be, and there are many metrics I use—but I do know we aren’t there yet.

As I elaborate more in detail behind the paywall in my research service…

I believe we are just at the beginning stages of a very challenging time in the global economy.

A time when I believe the US Dollar will remain strong, and likely a very challenging time for the economy.

But fortunes are made in these types of markets.

If you have cash ready and if you know where to look.

Regards,

Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.