Canada has produced some amazing scientists and inventors that have changed the world for the better.

Alexander Graham Bell, the inventor of the telephone, was a British subject in Canada.

The first ever long-distance phone call happened in Canada in August 1876. Bell made the 7.8 mile call between two small towns in Ontario, Canada (Brantford and Paris).

Every diabetic in the world can thank Frederick Banting, the inventor of insulin.

Banting was the first Canadian to win a Nobel Prize. And like a true Canadian, he shared the proceeds with his team.

Pretty cool, eh?

But there is one incredible Canadian scientist that has made the biggest impact on Canada’s GDP. And I bet you’ve never heard of him.

Because of this scientist’s brilliant discovery, almost 10% of Canada’s present GDP has directly resulted from his efforts.

You’ll never find his name in any secondary education textbook in Canada. He isn’t on any Canadian currency. He should be, but he isn’t. And probably never will be.

Yet, he is a true Canadian hero.

Let me explain why this unknown chemist, Karl Clark, is one of the most important people in Canada’s history…

It Pays to be Unconventional

Only Saudi Arabia and Venezuela have more proven oil in the ground than Canada.

But most of the oil in Canada isn’t oil that’s easily extracted, like the conventional oil in Saudi Arabia. In Canada, most of the oil is in the “oil sands”.

The original residents in the region of the oil sands (mainly what is Alberta today) used the sticky, black and very thick liquid, called “bitumen”, for waterproofing their canoes and roofs. All found naturally at surface.

Other than waterproofing, most ignored the value of what would become the world’s 3rd largest oil deposit.

That was until Karl Clark came along.

He recognized Canadian oil’s incredible value and cracked the secrets of the oil sands.

Long story short, Karl Clark figured out how to separate the oil and the sand.

It’s an incredibly complicated process. But Karl unlocked the secrets to what would become one of the world’s largest oil complexes.

More than $250 billion has been invested in the Canadian oil sands over the past 40+ years. As a result Canada has become the 7th largest oil producer in the world.

Nearly every major oil company has made an investment stake in the oil sands – ExxonMobil, Chevron, Royal Dutch Shell and even BP.

But none of that would be possible without Karl Clark.

Canada’s New Oil Dilemma

The history of Canadian oil production has been incredibly difficult and volatile, to say the least.

From boom times to bust, the “oil patch” has felt the pain like farmers do during incredible droughts.

Few periods have been worse than the current drought. But this one is happening during strong oil prices.

And it’s completely the fault of every Canadian in Canada – allowing foreign interests to dictate what’s best for Canada, its environment and its people.

I have been to over 100 countries, including oil producers like Kuwait and Iraq.

I can tell you without a shadow of a doubt, the oil produced in Canada is the most ethical, safe and moral of any oil in the world.

And yet, perhaps this Canadian misjudgment is more my own fault than others.

Let me explain…

Back in 2014, I was asked by a senior advisor and mentor to Canada’s Prime Minister, Justin Trudeau, to be on his energy advisory panel.

I politely declined.

This former Federal Minister felt that with my background and knowledge, I’d be a value add to the Justin Trudeau platform.

Canada, I’m sorry I didn’t do more.

Canada’s $100 Billion Dollar Loss… And Counting

You are reading this article for one of two reasons:

- You want to better your portfolio, or

- You work for an NGO and are building your file against me. Continue to do so, hopefully you’ll learn something.

I can’t do anything about the people in category 2. So let’s focus on the first group, which also includes those who are looking to better society and contribute to it…. And not just the people asking what the nation can do for them.

A $100 billion dollar loss is big for America, never mind Canada.

Our economy is less than 10% of our southern neighbor’s.

And, most of our oil infrastructure has been based around feeding Canada’s big brother’s (America’s) appetite for oil.

But American ingenuity like fracking (which was led by George Mitchel two decades ago) left Canada’s oil industry at a major disadvantage.

How Bad Is It?

Really bad.

But if you’re a value investor, you should start looking at the current reality of the Canadian oil patch.

Let’s take a look at a few big name companies…

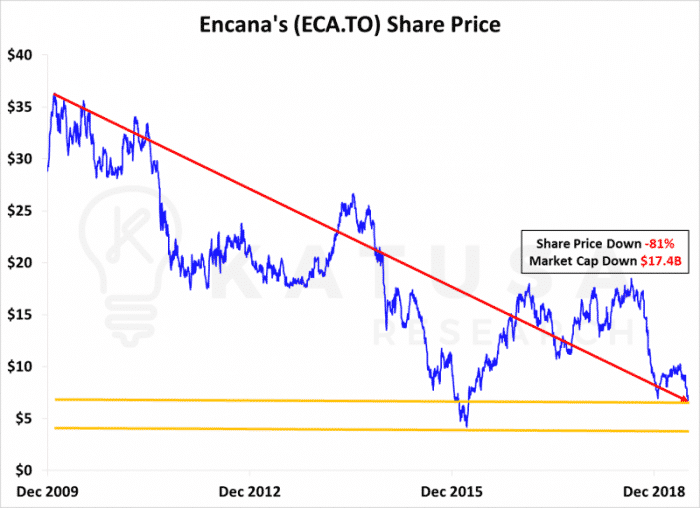

One of the oldest energy companies in Canada is Encana (ECA.TO).

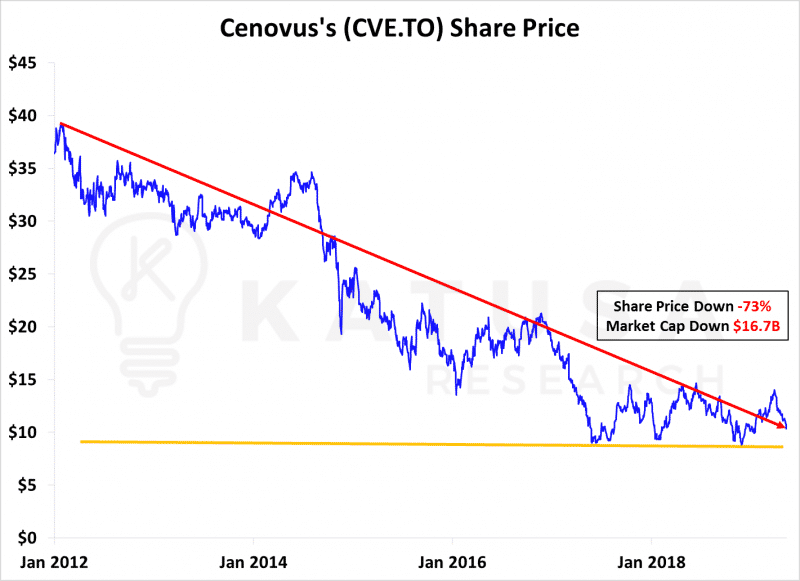

Post global financial crisis, Encana split itself into two; Encana and Cenovus Energy (CVE.TO).

The market cap of the company pre-split was $42.3 billion.

One year after the split, the two corporations’ combined market cap was $44.8 billion, a 5.8% increase.

However, the U.S became a net exporter of oil. Yes, the U.S. now exports more oil than it imports. As a result, both companies have seen their stock price fall off a cliff.

Here’s a chart of Encana…

And here’s the destruction of Cenovus…

Just these two companies alone have lost $34 billion in market cap since their highs.

Remember, the energy sector is the largest segment of the Canadian private sector, making up just under 10% of Canada’s GDP.

It gets worse.

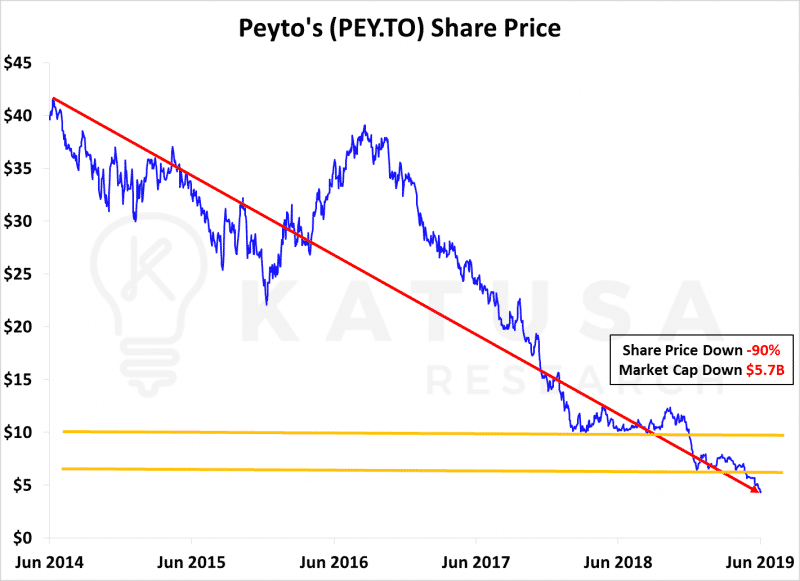

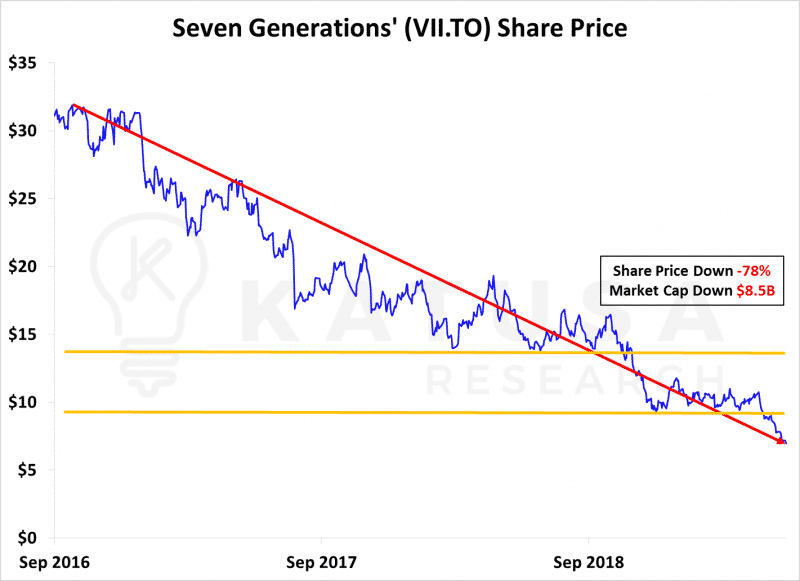

Innovative companies like:

Peyto (PEY.TO)…

Seven Generations Energy (VII.TO)…

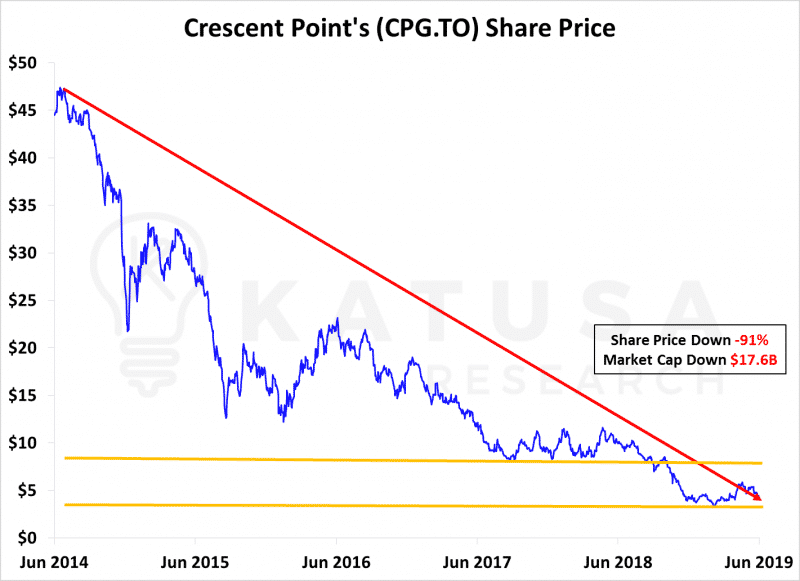

Crescent Point (CPG.TO)…

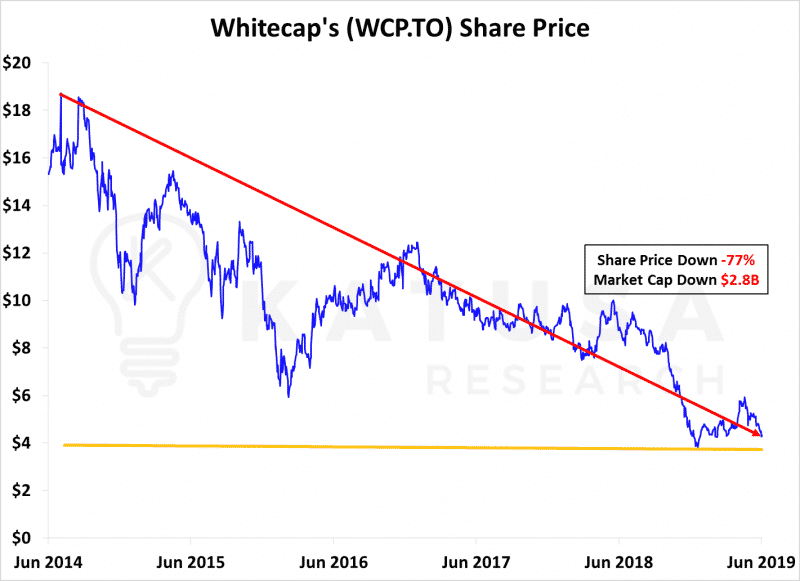

Whitecap (WCP.TO)…

…Just those 6 companies I mentioned above have lost $46.6 billion in market cap in the last 5 years.

The entire Canadian oil patch has lost over $100 billion in market capitalization over the last 5 years. That’s colossal destruction of wealth.

Even Canada’s Pension Plan fund has chosen to shy away from its own oil and gas industry.

As of this spring, the Canada Pension Plan’s Canadian oil and gas equities holdings represent less than 0.5% of the fund’s total value.

The billion-dollar question is this… will it rebound?

No, sadly it won’t.

But let me explain what has to happen in the Canadian oil patch…

Survival.

A newly elected conservative provincial government in Alberta (where the oil sands are located and where most Canadian oil is produced) will do whatever it can provincially to help the oil patch.

But, it’s a Federal issue.

To get the Canadian oil patch back on its feet, Canada has only one option:

International Markets – Oil Demand

China is not waiting around for Canada to gets its act together.

China has always had a China first policy. And so they should. It’s irrelevant whether China get their oil from Kurdistan, Russia or Iran. The only thing that matters to them is that they have enough oil in their refineries to meet their domestic needs.

Japan and Korea are the logical alternative for Canada’s oil exports.

Both countries have a long history of their largest state-owned enterprises being direct owners and offtake users of Canadian products. Coal, copper and lumber have all been positively affected by Japanese and Korean consortiums.

Mr. Trudeau – Open Our Borders

I think Prime Minister Trudeau will win the next election.

In fact, I bet one of Canada’s largest investment advisors 100 ounces of Canadian minted silver that Trudeau will maintain his office.

As a side note, you may have found that when I bet, I bet 100 ounces of silver. That’s because in Roman times, a gentleman’s bet was always 100 silver coins.

Now, back to reality…

I think with some solid leadership from our Prime Minister… it’s not too late to export moral and ethical Canadian-made oil to the world.

That will take time and a lot of politicking. And frankly, I don’t have much patience for that route.

So how do we make this current washout a win?

Everyone loves quoting the line “Buy when there is blood in the streets”, which is attributed to Baron Rothschild.

But everyone also loves to be a contrarian, until it’s time to actually put in a buy order in a hated sector.

We are way beyond blood in the streets for the Canadian oil patch. The carcasses are rotting.

There will be Bankruptcies.

Frankly, I am not buying any new positions in the Canadian oil patch until I see two things:

- Who wins the Federal election in October 2019, and

- If all of the support lines in orange in all of the charts above get broken.

There isn’t much I can do about #1. But if Trudeau comes out with an even more anti-oil rhetoric, then stay on the sidelines as the whole sector will go lower.

The rest of the world is fast tracking their oil development. There is NO point having your dollars exposed to a backward mentality. Neither communist nor socialist mentalities ever bred successful investment growth.

Later this year, I believe that the remaining support lines labelled in the above charts will all be tested.

Will They Bounce or Crack Support?

My instinct tells me that the support lines will be broken. Share prices across the board will go lower.

Never try to catch a falling knife.

I prefer to let the safe fall, hit the ground, bounce back up, then have the safe crack open upon impact with the ground… then bounce around for a bit and then walk up and pick up the cash while it’s just sitting there.

Fortune Favors the Bold, but Pays the Prepared.

My team and I have been preparing our special report on how to play the disaster in the patch…

All of the analytical modelling Goldman Sachs can do will be included, but with a serious dose of skin in the game and street sense.

I’m not an analyst who works for a big-name firm who isn’t allowed to buy stocks on the research I write, telling you what to put your dough into.

I disclose my cost base, and you can decide to get in at the same time and price. And you get to sell before I do.

I’m looking to make some big bets in the patch…

…Not quite yet. But when the time comes, you will want to know where the best bets are.

No different than what my subscribers just got – an alert to a financing that I personally back stopped, with the best terms of its kind ever done on the Canadian stock exchange.

Like I said, Fortune Favors the Bold, but Pays the Prepared.

Regards,

Marin

P.S. The incredible opportunity for a triple-upside financing I published about last week is almost completely filled by Katusa Research subscribers. With only a few spots left, consider subscribing to Katusa’s Resource Opportunities to see how I plan to get paid handsomely and still have increased upside in these turbulent markets.