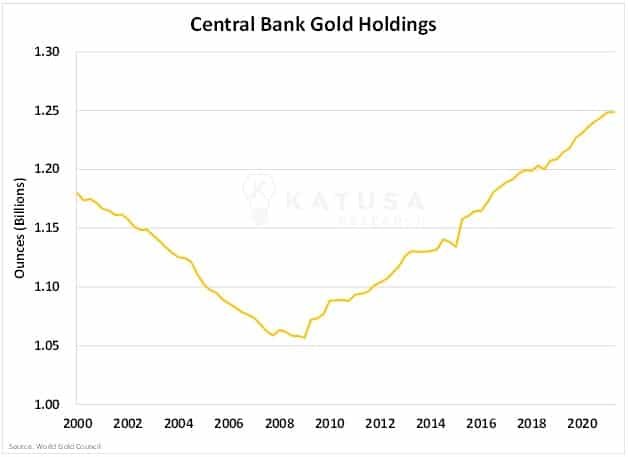

Since the start of the year, central banks have purchased over 4 million ounces of gold.

April was a big month for central bank activity. Over half the amount of gold purchased in 2021 was in the month of April alone.

- In April, central banks acquired 2.45 million ounces – worth over $4.3 billion.

Gold reserves in central banks continue to appreciate and are at the highest levels since the World Gold Council began keeping track in 2000.

Take a look…

But central banks aren’t the only ones bolstering their balance sheets these days…

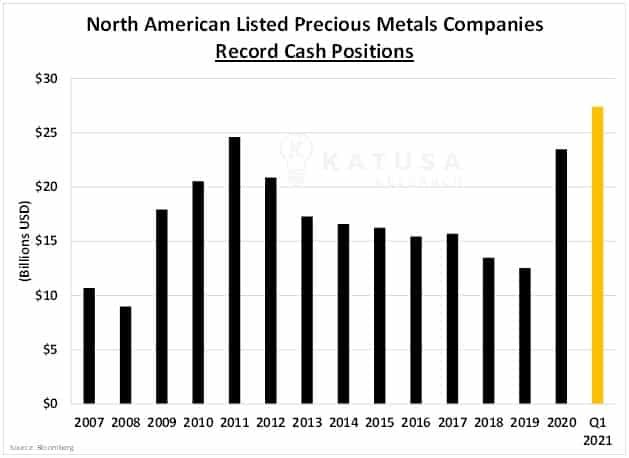

Gold Producers Balance Sheets: The Healthiest Ever?

After a decade of continuously declining cash reserves, gold producers are flush with cash today.

In fact, the gold producers have never had more U.S. Dollars on their balance sheets than they have today.

- In fact, over the last 15 months, at the sector level, cash reserves have more than doubled.

Today the cash positions for North American listed precious metals companies are over $27 billion. And thanks to strong gold prices, I expect them to climb even higher.

$1,850 Gold = Fat Profits for Gold Companies

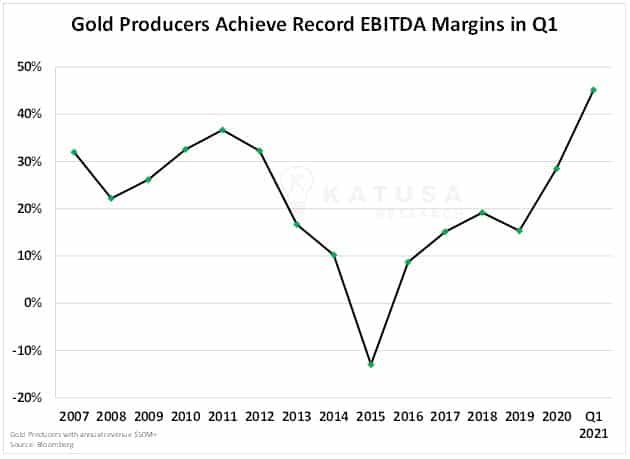

This dramatic boost in cash reserves is primarily due to the current gold price and lack of new large production projects by the industry as a whole.

Gold producers kept operating costs in line all through the mid-2010s when gold prices were depressed. In doing so, they’ve all now been provided with the opportunity for rapid profit margin expansion.

Going back to as far as 2007, EBITDA margins have never been as high as they were in Q1 this year.

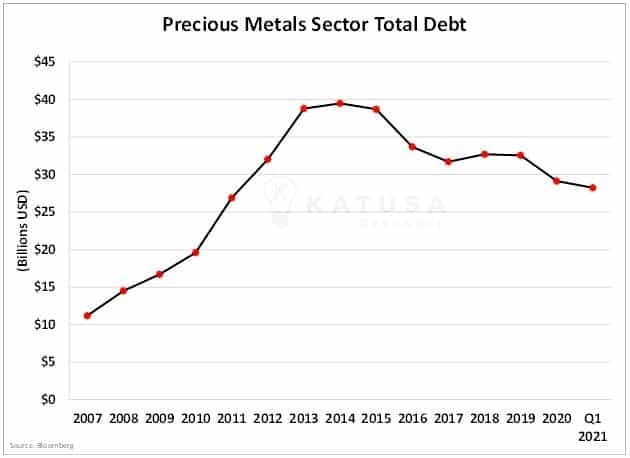

A delicate balance of debt and equity optimizes returns to both debt and equity holders. These improving profit margins have led to gold producers reducing debt on their balance sheets.

Total debt has declined over 28%, from $40 billion in 2014 to $28 billion as of March 2021.

Margins are up and debt is down, so…

Here’s What This Means for Gold Stocks…

Strong gold prices mean faster payback of capital for miners.

This improves asset valuations and supports higher share prices.

Strong profit margins and declining debt profiles set the stage for gold producers to improve shareholder returns through 2 major ways:

Improve alignment with shareholders through increased dividends and buybacks.

- After a decade of paltry distributions to shareholders, investors will be demanding cash being returned to them instead of to corporate pockets. This is a similar situation to what we’ve seen in the oil patch over the past 12 months as companies fight to keep shareholders invested.

And eventually…

Acquisition targets.

- Income that’s not returned to shareholders should be reinvested into growth opportunities (either organic or acquisition). Strong gold prices provide support for takeovers and incentivize companies to grow through acquisition.

Gold Merger Mania: About to Heat Up?

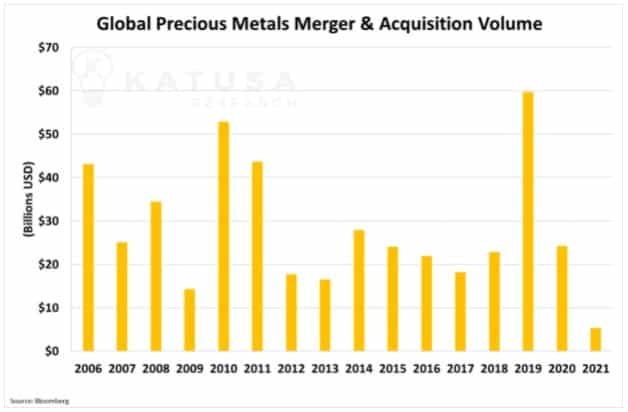

Transaction volume in 2021 is off to a slow start…

But given the balance sheets and strong gold prices, more deal volume is likely in the second half of the year and into 2022.

And as deal volume picks up, I believe there’ll be a premium paid for deposits in +SWAP Line Nations.

The reason is two-fold:

- There’s less jurisdictional risk in +SWAP Line Nations. No miner wants their mine nationalized, nor do they want to give up +25% for free to the government. As a shareholder you shouldn’t either. Today I see far more complacency with this than ever before. Yet there’s a never-ending barrage of headlines for increased royalties, taxes and government takes.

- High quality deposits are hard to come by. Average grades are dropping and have forced miners into the -SWAP Line Nations. This makes those deposits located in safe jurisdictions that much more valuable.

So, what’s the best way to identify which deposits – and which companies – will be at the top of each gold mining major’s shopping list?

You could sift through hundreds of technical documents and spend years traveling to remote areas while completing thousands of hours of due diligence…

Or you could take the easy route.

As a professional fund manager focused on the natural resource space, I’ve dedicated my career to this sector.

I know all the big players and have one of the best rolodexes in the game.

As an example…

- A very large position in my own portfolio (and one my subscribers are up 400% on) is led by the “Gentleman of Mining”.

And he hasn’t even done a single institutional presentation.

To be successful in investing you must get ahead of the curve.

Another large position is backing a billionaire and serially successful resource tycoon…

It’s a gentleman whom I’ve known for a decade and have made millions of dollars with, due to success on his previous deals.

My subscribers know exactly what prices I’m willing to buy and sell at.

At Katusa Research, I’m not just about delivering these winning stock picks to subscribers of my premium research service – I’m also about educating investors.

I freely share my research with my subscribers, and always outline my exact due diligence process every time I recommend a new idea.

- Instead of loading up on the latest meme stock over at WallStreetBets for a shot at the moon, consider subscribing to Katusa’s Resource Opportunities.

And you can learn about my alligator strategy of investing.

Regards,

Marin