The beautiful thing about the stock market is that there is a never-ending source of opportunity.Trillions of dollars are constantly on the hunt for one thing: alpha.Alpha is known as the return of a portfolio over a benchmark.

- Searching for the next source of alpha can lead to massive profit windfalls for hedge fund managers and their clients.

These sources are exploited as fast as possible and the investment strategies which reap this alpha are treated like wartime trade secrets.Today the stock markets are supposed to be efficient.This means that stock prices accurately reflect publicly available information.Sometimes, however, there are exceptions.When these exceptions last for long periods of time, they are known as market anomalies.

The “January Effect” is a Market Anomaly

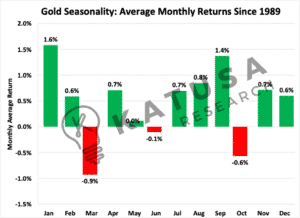

For many years, stock market returns in January have consistently been some of the strongest returning months.Market timers can use this to their advantage and improve return performance by buying strategically at turning points.The gold market is no exception and as you’ll see that there are some large gains to be had.Below are all the monthly returns for physical gold since 1989. As you can see, on average, January reports the strongest gains.

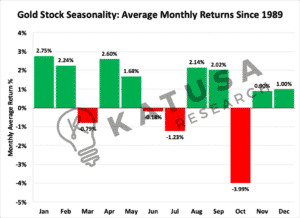

Exposure to gold producers leverages the return potential over just buying physical bullion.If nothing else, January 2022 will have the benefit of being the first month post tax loss pressure from a rough year—just like 2021 was for the gold producers.

It makes sense then if you’re looking for an edge in the gold market…

- An investor should examine the January effect on the returns for gold focused stocks.

Higher gold prices should translate to higher share prices.And as you will see in the chart below, the profits and losses are magnified…

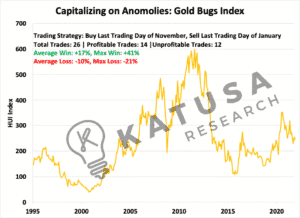

Using a very basic market timing strategy of buying on the last day of November and selling the last day of January can capture the “January Effect” very well. Below are statistics for the period 1996-2021. Over 50% of the trades are profitable, while the average win rates and largest wins are considerably higher than losses.

- Average Win + 17%, Largest Win +41%

- Average Loss -10%, Largest Loss -21%

- Total Return from strategy +141%

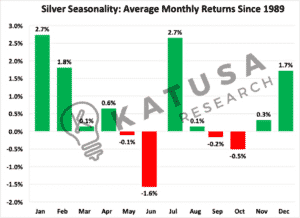

Silver Season Trading

Don’t worry silver bugs, I didn’t forget about you before Christmas.For all the silver fans out there, I’ve got a few stats that you can use at your silver bug Christmas party this year.The January effect is even more pronounced for silver.

- Clocking in at an average +2.73% return, January is the largest profitable month on average for silver.

Starting in 1996…Using the same simple strategy of buying silver on the last trading day of November…And selling silver on the last day of January leads to impressive gains:

- Total Trades 26, Profitable Trades 19, Unprofitable Trades 7

- Average Win +10%, Max Win +23%

- Average Loss -8%, Max Loss -13%

- Total Return from strategy +299%

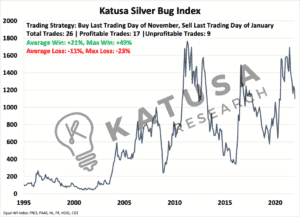

Like in gold, exposure to the silver producers leverages the return potential.Unlike the HUI Gold Bugs Index, there is no “silver bug” equivalent, so I created one.Below is the index and the associated performance for the January effect. Again, you’ll see the gains and losses are magnified.

Using the same buy in November, sell in January approach, the returns are very high.

- Average Win +21%, Max Win +49%

- Average Loss -11%, Max Loss -23%

- Total Return from strategy +600%

What The Gold and Silver Commitment of Traders are Saying…

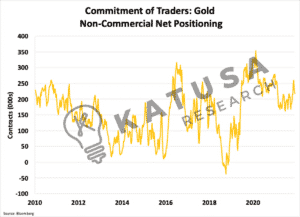

You would think with this type of predictable performance, we’d begin to see positioning in the non-commercial group in the Commitment of Traders report.But so far there has not been any noticeable spike.Below is the net positioning, (longs minus shorts) for the non-commercial group for gold.

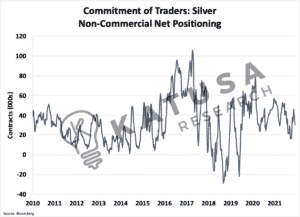

And here is the net non-commercial positioning for silver.

As inflation expectations continue to rise around the world, central bankers find themselves in a tough spot.

- Slowing the spigot of cash at just the right pace is nearly impossible to gauge.

The market has become incredibly reliant upon asset purchases and supportive central bank actions.Aggressive moves to curb inflation and slowing or entirely removing asset purchases risks the market being able to adequately support itself.Whereas allowing large stimulative asset purchases and near zero rates creates long term inflationary risks.

SPONSORED CONTENT

I position myself and subscribers in anticipation of major macroeconomic events.I do believe that 2022 will provide large amounts of volatility, which creates major opportunities.And as all my subscribers know…We’ve been very selective with our favourite deep value best of breed gold positions that we believe will result in above market returns. They have in the past, and we expect our framework to continue delivering above market returns.Global economies have proven to be resilient but what happens when central banks begin to slow asset purchases is yet to be seen.Subscribers and I have begun to slowly accumulate positions in favorite stocks.

- One of my largest investments (where subscribers bought at the same prices alongside me) just hit a new all-time high.

And I think it’s just getting started.

Stocks on our tax loss hit list are also all getting closer to getting filled…While my latest core investment continues to surge higher on a major macroeconomic theme. (Note: This is something critical to every single portfolio).It’s alligator time in the gold sector.If you felt like 2020 was a tough year for your portfolio and you want to give yourself an edge in 2022 and beyond, Katusa’s Resource Opportunities could be for you.Click here to learn moreRegards,Marin