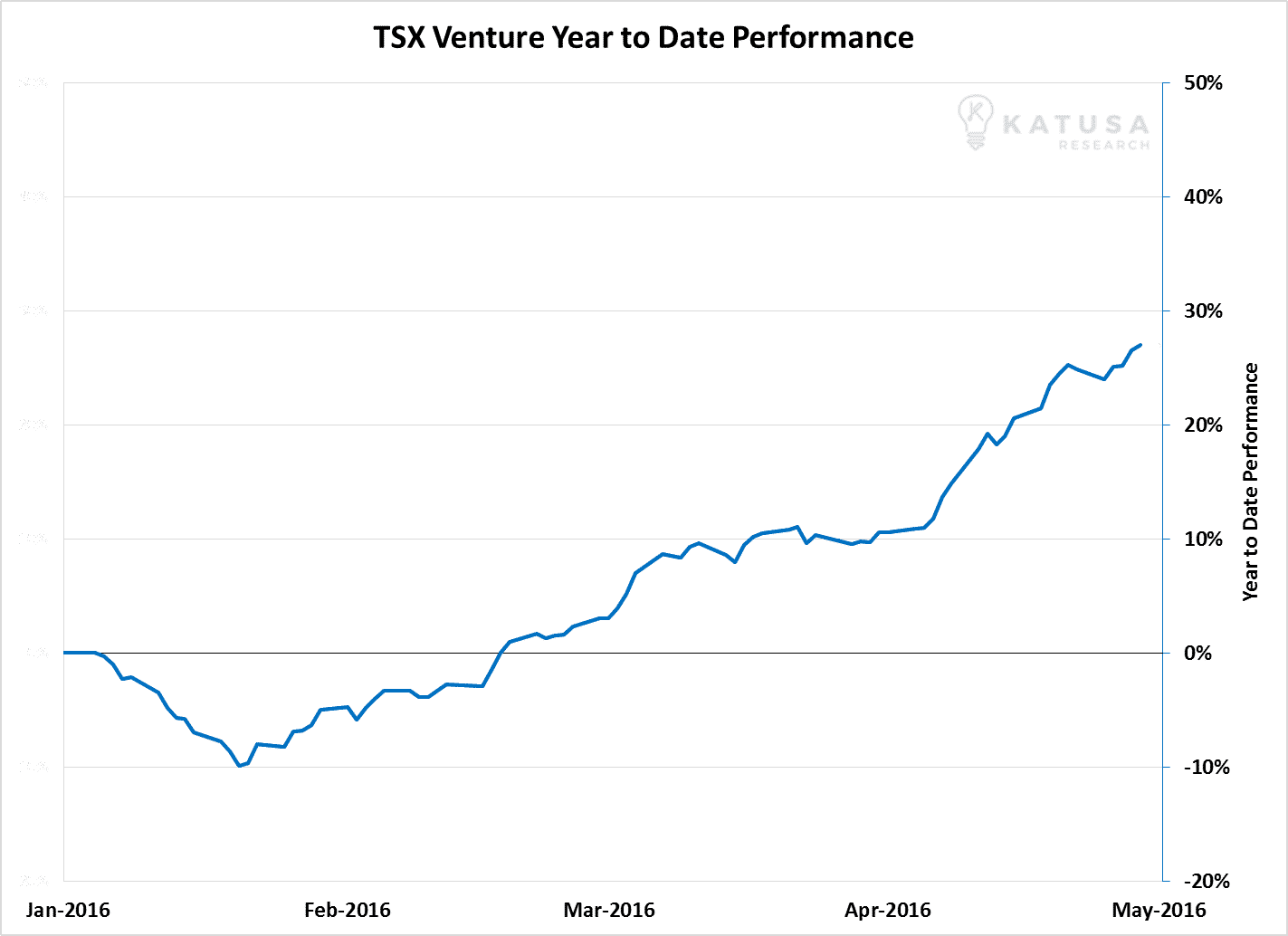

Most junior natural resource companies are listed on the TSX-Venture and, needless to say, it’s been an interesting first 4 months of the year.

We can see since the turn of 2016, the TSX-V is up over 25%.

There is a lot of enthusiasm in the streets and online and for good reason. Many companies, through merit or not, are sitting at over +100% gains YTD.

This is why I love this business.

The juniors provide massive upside leverage with the hint of new capital entering the markets.

So what’s changed?

A couple of things…

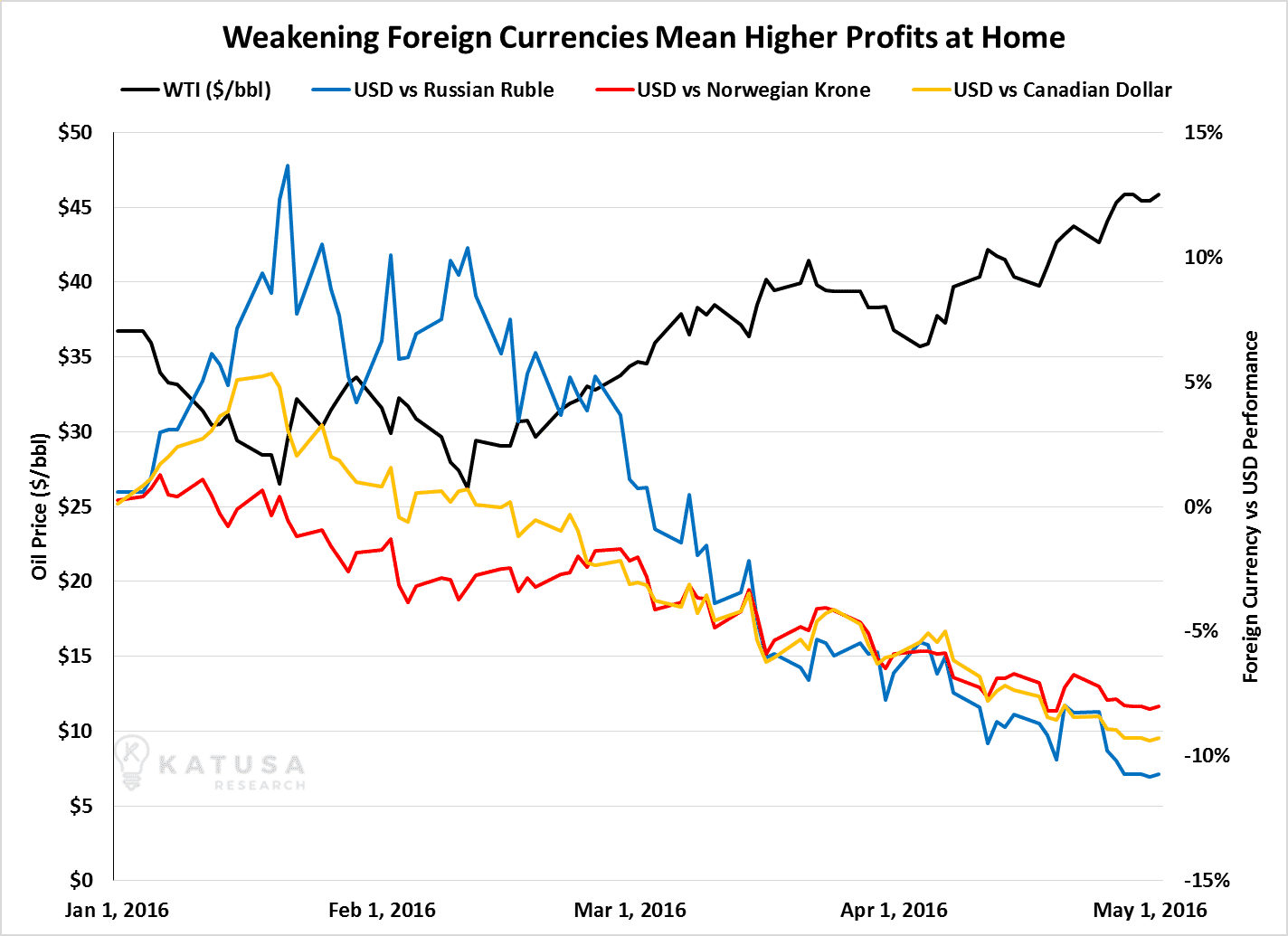

First, the US Dollar has trended down against currencies of commodity rich nations like Canada, Norway and Russia. These currencies perform well when oil rises.

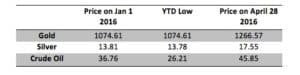

In turn, the price of assets like gold, silver and oil rose too.

Second and most important – confidence.

With confidence edging its way back in, the market presents an opportunity for you to get out of the crap you own that hasn’t panned out in the past. Only position yourself in the absolute best junior exploration companies, run by the best management teams, which have a considerable amount of their own capital at risk. Only own the best of breed.

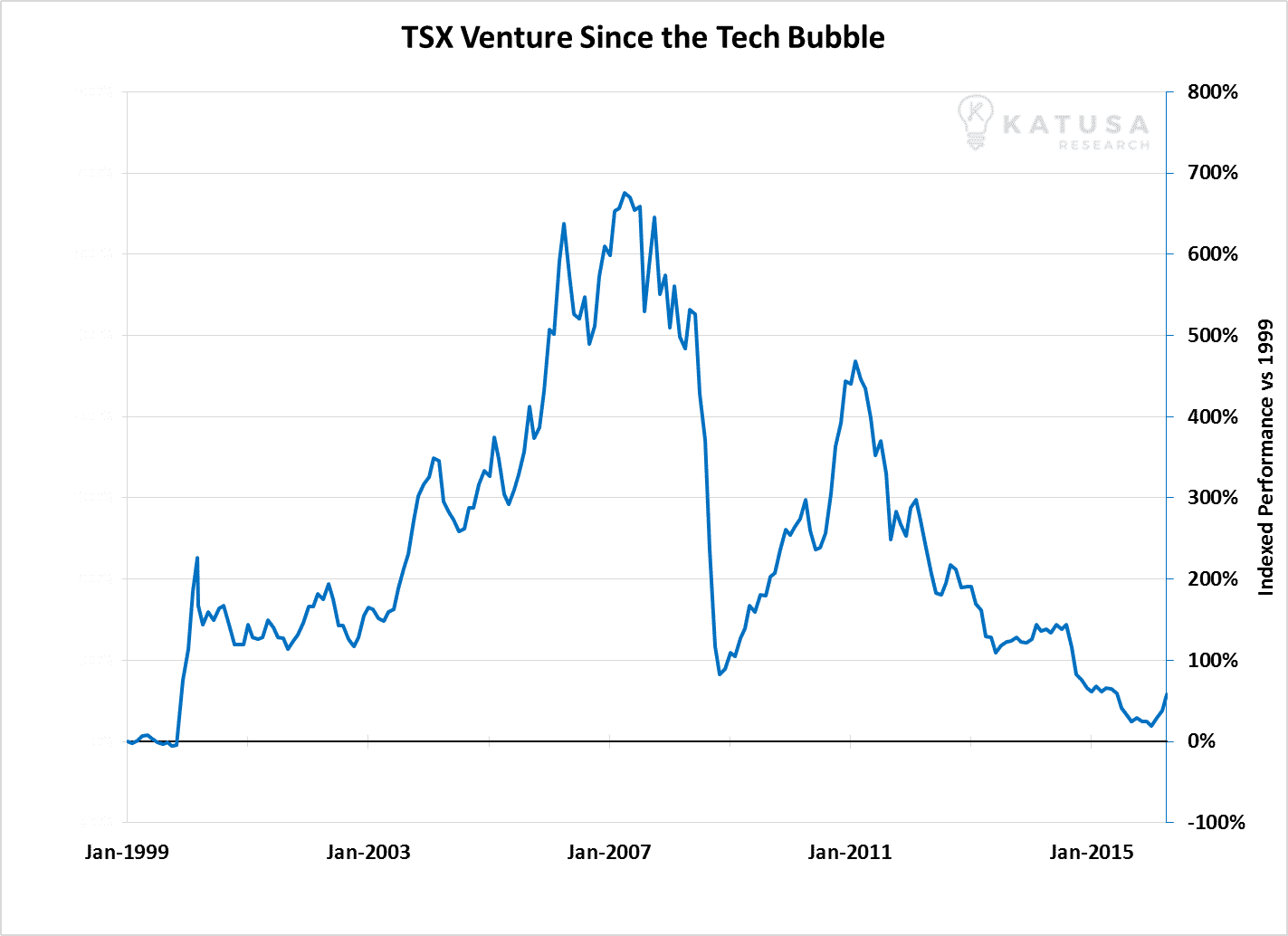

We’re a long way from a frothy secular bull top.

This could be the beginning of the lucrative stealth phase climbing the wall of worry.

Even with the uptick in the juniors in 2016, we’re still at levels near the bear market bottom of the early 2000’s before the greatest bull market run in commodities ever.

I’m closely watching companies that were nearly bankrupt now raising money through financings to keep the lights on and pay management fees. A few months ago I saw eviction notices plastered on the doors of many company offices around downtown Vancouver – the natural resource hub of the world.

These financings will keep them afloat for the foreseeable future. And I must say, I’m shocked that some of financings are oversubscribed. This shows the appetite that investors have to deploy their capital in high-risk, high-reward asset classes.

Just know what you are buying. I know I do. I hope you do too.

Greed is back.

-Marin Katusa

PS. I’m thankful for all the kind notes from readers that did well with Newmarket Gold and McEwen Mining. I have plenty in the pipeline that will give you an edge to the street.