Ultra low interest rates and ever depreciating currencies are the new normal. It’s a race to the bottom so to speak.

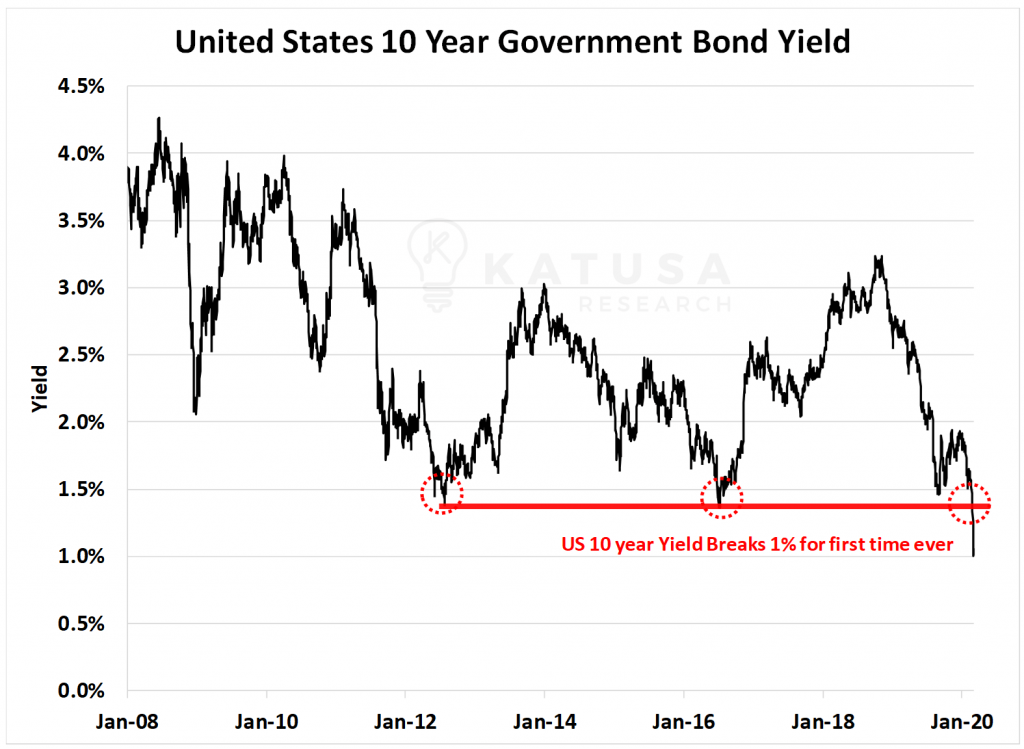

Last week we profiled the most important charts to keep an eye on during these turbulent times. Among them was the 10-year US Treasury yield.

And this week it broke below 1% for the first time in history.

How do falling interest rates impact my portfolio?

Whether you’re a billionaire or a single mom, negative interest rates will have major implications.

From your job security to the price you pay for gas, to your monthly mortgage payment… to your “balanced” investment portfolio.

So what has happened this past week?

Bonds are trading like stocks (not normal).

Trading platforms and exchanges stopped working (not normal).

Major markets are fluctuating 4-5% up and down in a day (not normal).

I’ve been getting a lot of attention recently about a concept I’ve created about how FTDs will distort negative interest rates and how Quantum Economics now plays into this all.

A lot of people think negative rates and Financially Transmitted Diseases (FTDs) are a short-term fix, kind of like what QE was after the Global Financial Crises.

I’m taking the other side of that bet.

In late 2019 I answered many of these types of questions in an interview with my buddies who own Real Vision.

This interview is a must watch to prepare to understand what’s coming next… and how to position yourself to profit.

I get into:

- How much lower interest rates can go

- What impacts this will have on REAL people

- What will happen to bonds (and how to play it)

- The new concurrent rise in the US Dollar and Gold

- Why your local currency matters A LOT in the large scheme of things

- The most interesting investment in the natural resource space

- The name of one of my biggest gold holdings

Click here to watch the video.

Regards,

Marin