Even with a new steering committee focused on a potential Chinese reopening…President Xi’s absolute control of the Politburo in China allows as much Zero Covid policy as desired. Regardless of the short-term economic consequences.Whether it’s to truly protect citizens from Covid or to control the masses…The end result is a very bleak picture of economic growth.Our forecast was the lower growth in China would directly result in lower prices for many commodities.In addition, the further tightening of monetary policy in the U.S. will lead to decreasing velocity of capital and lower growth.And the most recent earnings of Google (missed consensus by 15%) confirm that the recession warnings we wrote about many months ago are here.

- Google lost more of its market cap on October 26th than the sum of the total market cap of ALL Canadian Mining companies COMBINED.

- Meta (Facebook) is laying off 11,000 people.

- Amazon is laying off 10,000 workers in advance of their biggest money-making season of the year – Cyber Monday and Christmas.

- Musk terminated thousand of Twitter employees last week.

- And then there’s one of the world’s largest shipping companies, FedEX. They’ve furloughed workers.

When the world’s largest companies make company-altering decisions like this, you want to pay attention.

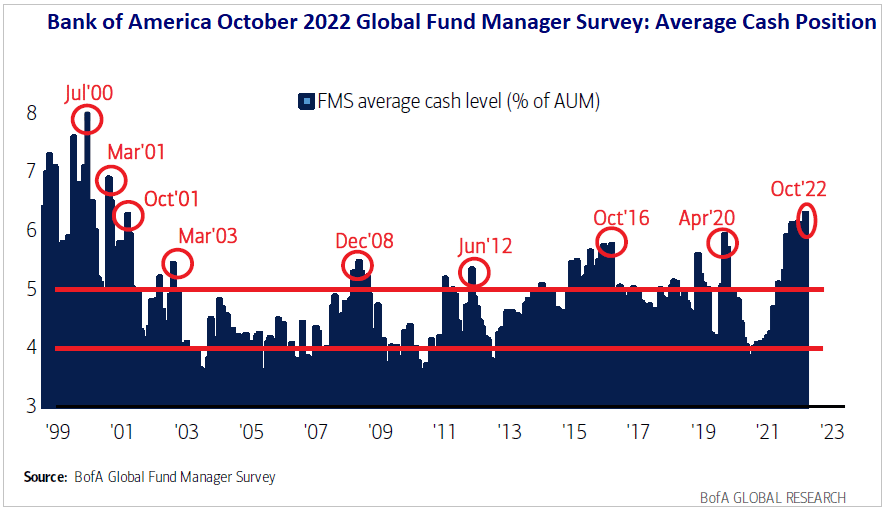

It is a Risk-Off Environment: Cash is King

Bank of America recently released a survey of 350+ fund managers which in total manage over $1 trillion.Cash positions amongst these managers are at their highest levels since the tech bubble.This is a sign of uber cautiousness from the big money managers…

This cautiousness is for good reason:

- Global growth is slowing

- Costs are going up

- Political instability remains high

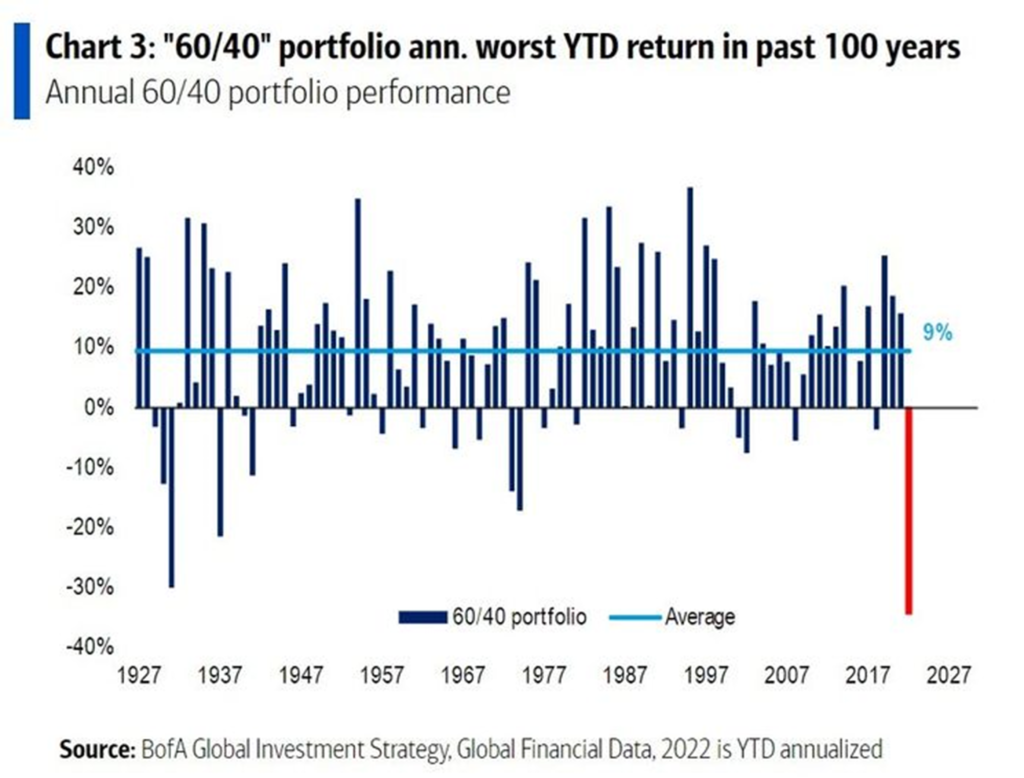

You don’t need me to tell you that equity and bond markets have been crushed this year.A traditional investment portfolio historically has a weighting of 60% equities and 40% bonds.This investment portfolio is having its worst returning year in 100 years.

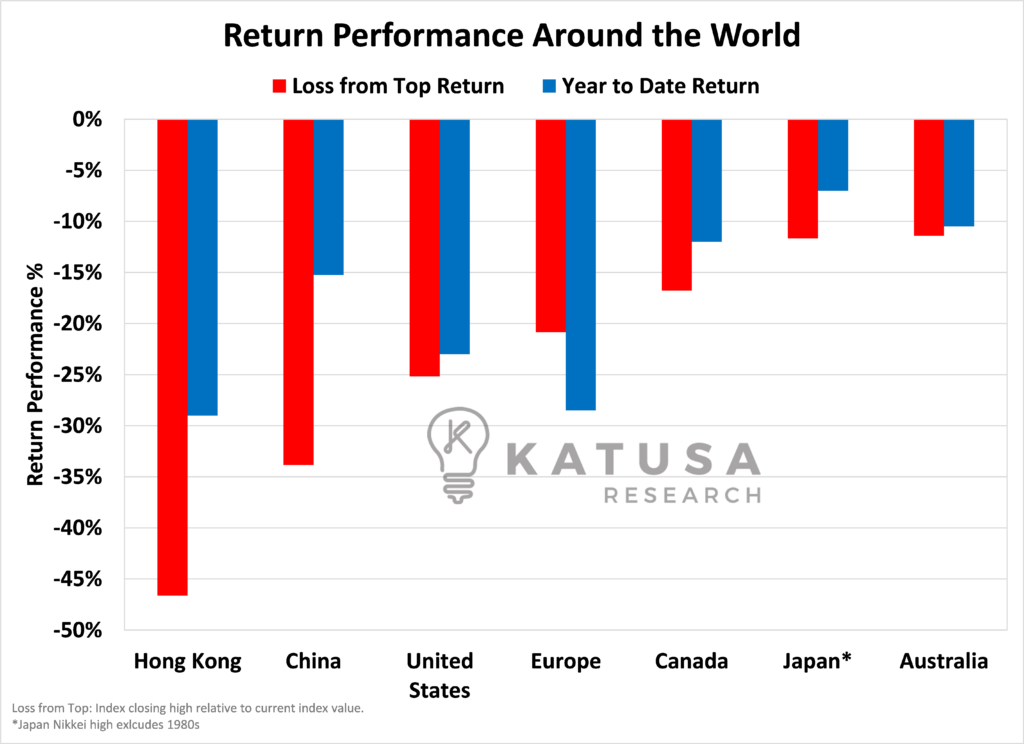

Equity Markets Around the World

There’s just nowhere to hide if you are a generalist investor.There isn’t a major stock market in the world that has generated a positive return year to date, and indices following the world’s largest economies are down over 20% from previous highs.

How Long Must We Sing This Song?

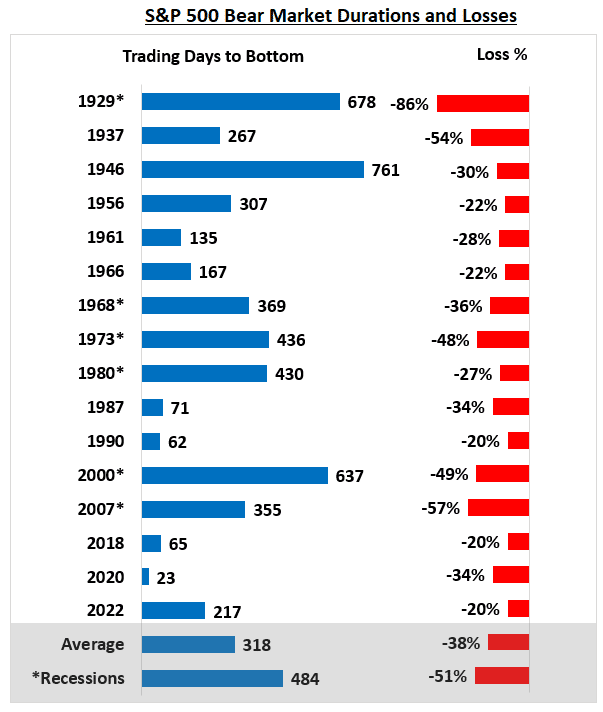

As the chart shows below, we likely are not out of the woods yet.Both in duration of decline and absolute loss…

As the chart shows, typically the S&P 500 will decline for nearly a year and suffer losses of 38%.If you look at the duration and losses during recessionary time periods, the picture is much uglier.

- During recessions, the average S&P 500 decline lasts 484 days while falling 51%.

Currently, we are sitting at 225 days of decline and a 17% decline.Could this time be different and the bottom is in? Sure, it’s possible. And every time we have a sharp bear market rally it looks like the bottom could be in. Last week’s massive rip was no exception.

But with interest rate increases by the U.S. Fed are not finished (I expect more to come as of this writing) and this makes me strongly feel we have more pain to come in the overall markets.I am not alone in this bearish view.Federal Reserve Chair Jerome Powell said taming inflation is going to be painful for the economy – and I agree with him.

- I don’t think there is an easy way out this time. Interest rates must go up.

Raising interest rates helps cool the economy by slowing the velocity of capital.There will be a time when the Fed pivots and the market will front-run this by several months, pricing in the fed action.But I don’t see that any time soon.

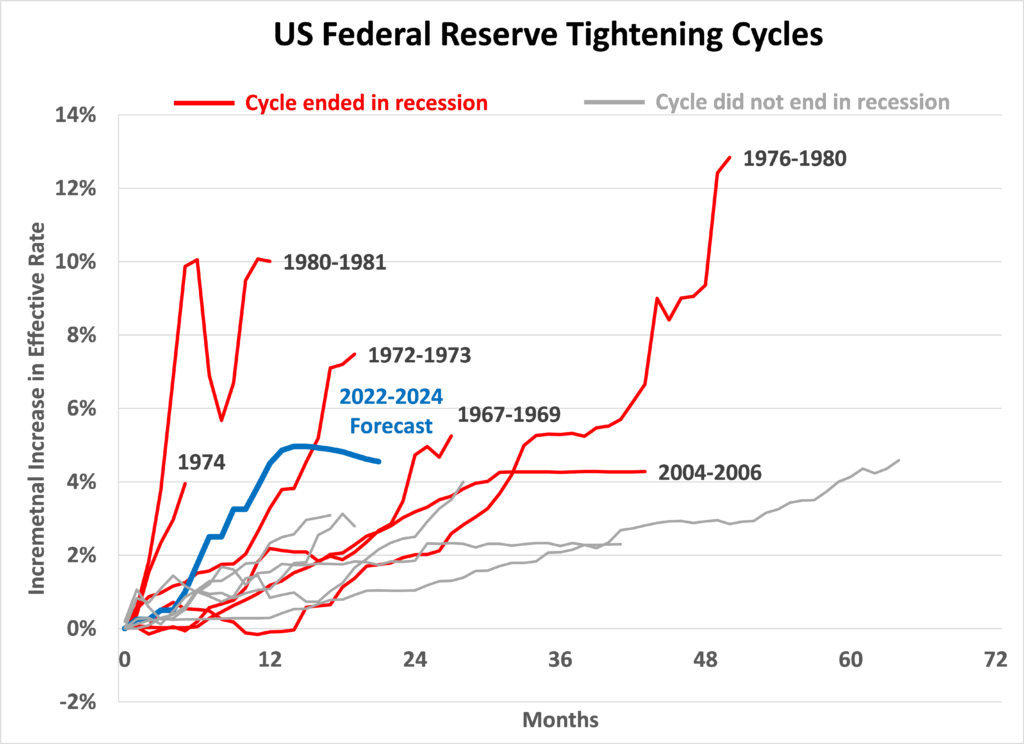

Rate Cycles’ Writing on the Wall

This would be the first time in Fed hiking history that rates would have risen in absolute terms this much, without causing a recession.Below is a chart that shows every major hiking cycle since the 1960s.

Virtually every time rates hiked above 4%, we ended up in a recession.This aggressive interest rate policy by the Federal Reserve has increased rates faster than other developed regions, charting a course for a very strong dollar.This rapid strengthening of the dollar has considerable macroeconomic implications for almost all countries, given the dominance of the dollar in international trade and finance.The dollar’s share in world exports has held around 40%.For many countries fighting to bring down inflation, the weakening of their currencies relative to the dollar has made the fight harder.

- On average, for every 10% increase in the dollar relative to another country’s currency, inflation in that foreign country goes up by 1%.

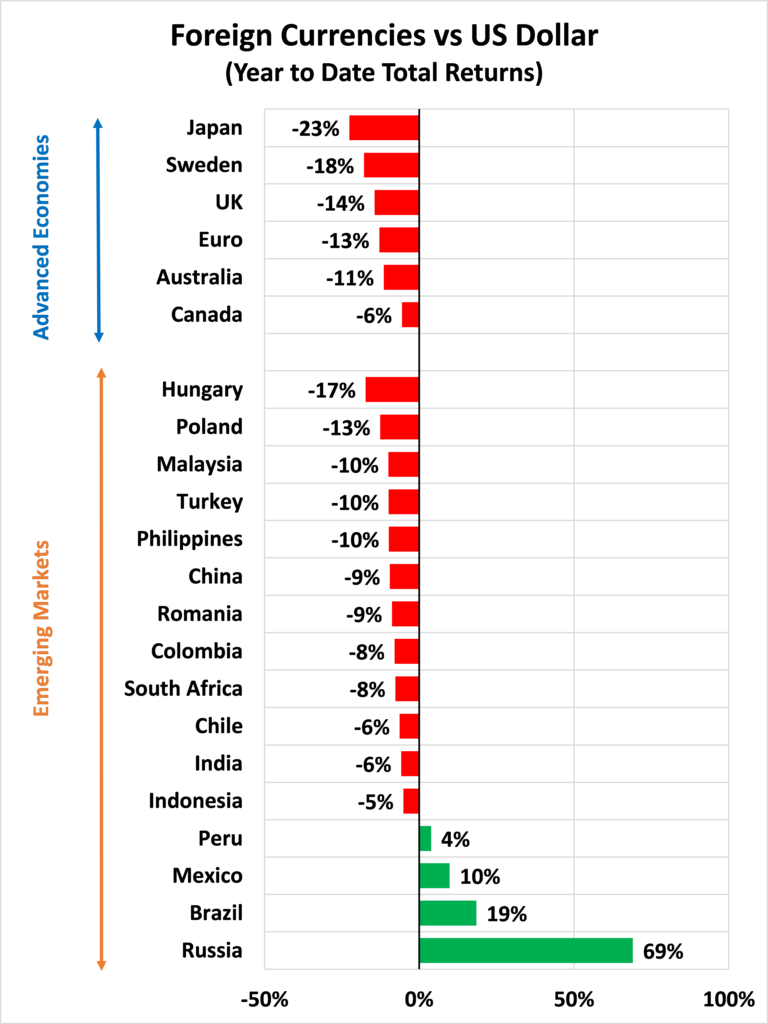

Foreigners Feel the Heat the MOST

This type of situation is felt most significantly by the emerging markets. Because they have high import dependencies, usually transacted in USD.This creates a spiral of requiring additional domestic currency to cover international transactions. And leads to further currency deprecations.The chart below shows the performance of foreign currencies vs the US dollar. You can see that outside of South America and Russia, the USD has strongly appreciated YTD.

This strong dollar as alluded to above, creates considerable challenges for nations that buy and sell goods in the international marketplace.Approximately 50% of all cross-border loans and international debt securities are denominated in US dollars.While emerging market governments have made progress in issuing debt in their own currency, their private corporate sectors have high levels of dollar-denominated debt.

- As central banks raise interest rates around the world, financial conditions tighten. It makes it harder and more expensive to borrow capital.

A stronger dollar only compounds these pressures.Especially for some emerging markets and many low-income countries that are already at a high risk of debt distress.A strong dollar is a trend I expect to continue for the remainder of this year.And this is a critical input into every one of my stock portfolio holdings.Regards,Marin KatusaP.S. You can follow my every move in the resource markets by becoming a subscriber to Katusa’s Resource Opportunities.Stocks are entering a window of valuations not seen in many years – and I intend to pounce like an alligator on the best opportunities.

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.