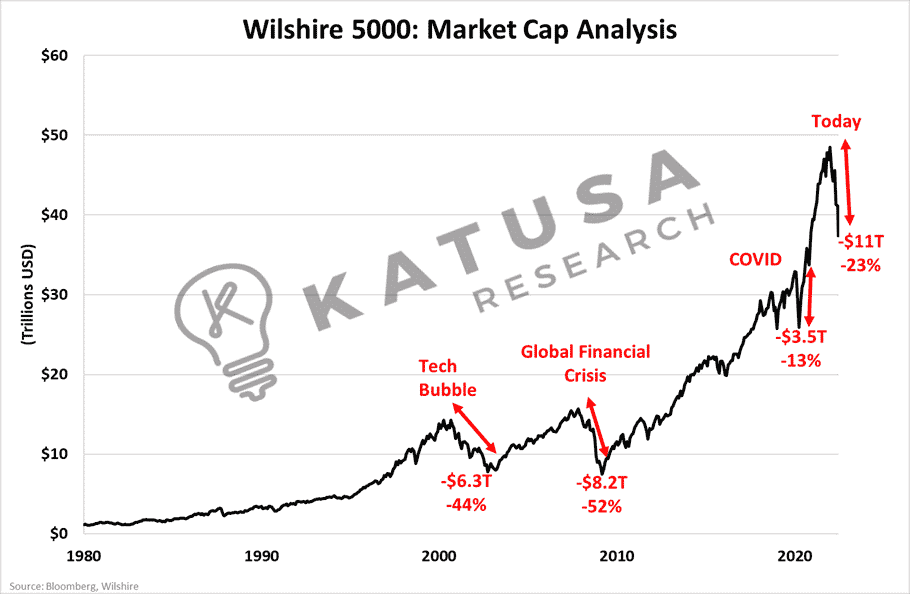

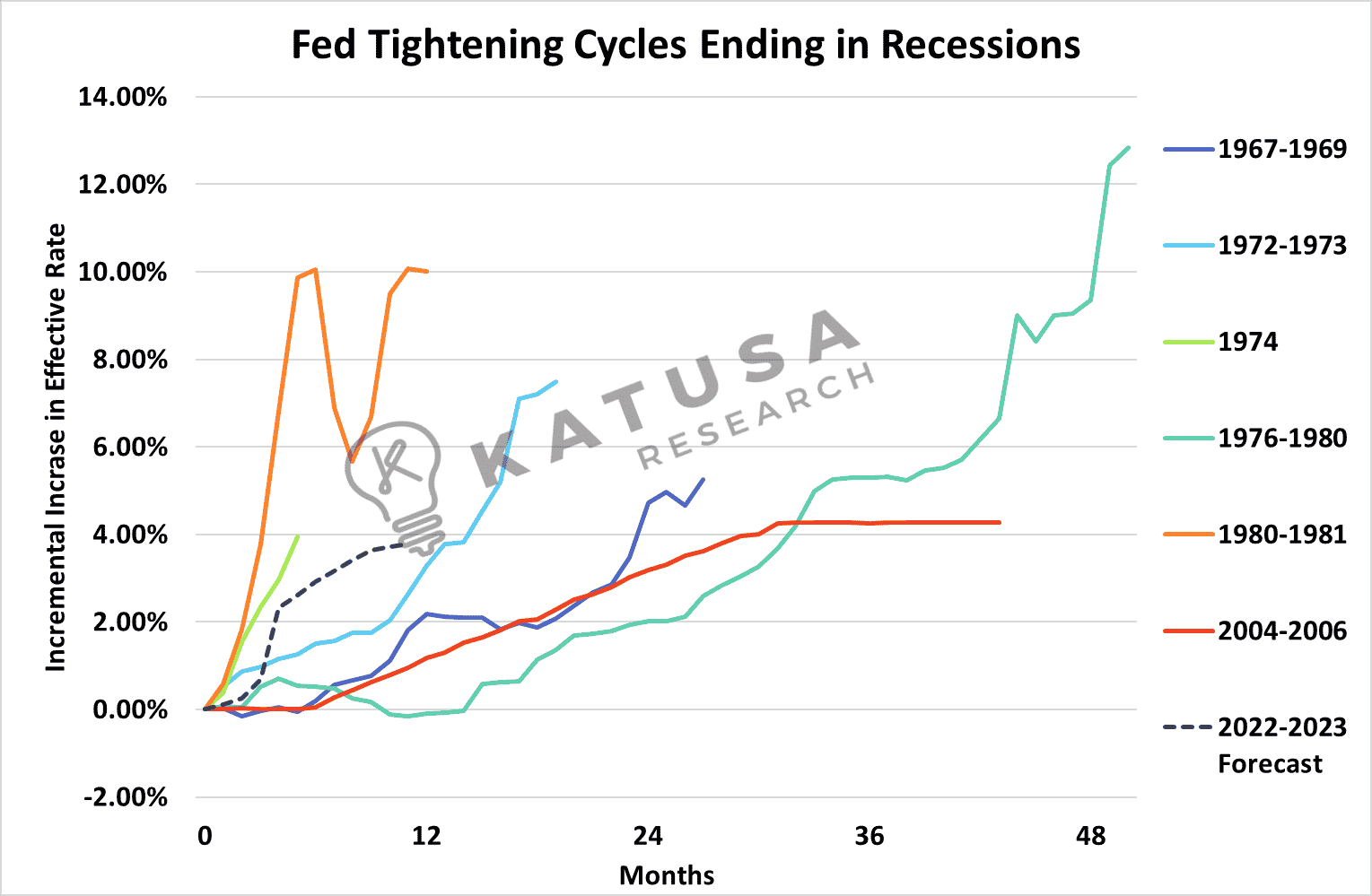

Historically speaking, the bond market is usually ahead of the stock market when it comes to trends.But with the past decade of low-interest rates, money chased any sort of yield which caused a lot of risk across the board.We can see that visually from the large drop in the bond market over the past few months which is greater in both dollar amounts and percentage than the previous 3 major market corrections as seen in the chart below.The Wilshire 5000, the broadest market gauge, is down 25.4% from the peak.This means that the amount of paper wealth that has vanished comes to $12.5 trillion (and over $14 trillion if you include crypto “assets”).The greatest liquidation in bonds EVER…From both a total dollar amount and percentage drop, is upon us.Take a look…

And here we have the macro bulls crowing over the $2 trillion of so-called “excess savings” on household balance sheets.They’re looking on as most Street economists do… in a static instead of a dynamic framework.It’s why they never catch the turning points in the business cycle.

Right now, we’re on the cusp of what may be the biggest market changes in resources in the last 50 years.

- The Fed fired its bazooka and is raising rates by levels not seen since the 1970s

- Tech and crypto companies are leading a meltdown in the markets. Many are down 50-80% from their peak. And the contagion is spreading

- Market sentiment and indicators are nearing extreme fear levels

This tells me that right now, we’re entering an era of incredible change…AND opportunity.One major change will be the psychology of not just government leaders but investors, business management teams, and everyday citizens.I think we are going into a market of a more de-globalization economy—and a focus on re-domestication of supply chains.

- It’s a time when my subscribers and I have been preparing for… for a long time.

It’s part of my “alligator” investment strategy – taking profits when everyone else is celebrating greed (like we did in 2021).And to stalk stocks and wait for an optimal time to pounce.That time is now.As we’re seeing, the world is going through a time of great change and upheaval.Geopolitical turmoil… international trade and energy wars…stagnating first-world economies… and some of the fastest rising interest rates in decades…

It’s all setting the stage for some of what I believe are the greatest investment opportunities we’ve seen in a generation.That’s why I published my special report, “5 Ways to Recession-Proof Your Portfolio”.These are some of the best companies in the world that I want to own in today’s markets.Here’s why…

- They are the best among their peer group.

- They are tier-one assets

- They are trading at levels not seen in a LONG, LONG TIME.

- They will pay me to wait out the recovery

- And if they recover, they could recover sharp and swift

Preparation for Crisis is Key…And we’ve been getting a lot of reader and member feedback during these unprecedented times…

“Congratulations on your first prediction for 2020 coming true early – I’m now reading your 2020 review a bit more carefully given the credibility of your analysis. Keep up the good work. It works like this that makes me glad I subscribed.”-Kelly I.

“I think I found if not the best, for sure one of the top places to start investing in stocks, and at the best time. Thank you again.”-I.M.

“I love your newsletter — it’s making me money! Thank you!”-Michael B.

“KRO is far and away the greatest resource newsletter out there. I have had exposure to others, and there is no comparison. What Marin personally puts into KRO has no equal elsewhere.”-Mark B.

“He is our Prometheus! He levels the playfield for us retail investors and has patiently educated us on how to become successful investors… we don’t care about daily market fluctuations.”-Calvin W.

And if you’re interested…I want to help you through this historic time in the markets.And show you how to potentially make some of the biggest gains you’ve ever seen in your life when this is all over…Click here to read my full report on how to Recession-Proof Your Portfolio.The deadline is fast approaching – don’t be a minute late.Regards,Marin KatusaP.S. If you missed my original emergency broadcast, you can rewatch it for the next 24 hours. Click here to view it.