“There are decades where nothing happens; And there are weeks where decades happen.”

-Vladimir Lenin

The “other yellow metal” has been on a wild ride for the past 2 months.

And the price appreciation of uranium has carried a lot of uranium company share prices with it…

- One of the Katusa picks was up as much as 1,500% at one point. And subscribers to Katusa’s Resource Opportunities were holding the stock.

Here’s why…

Uranium on the spot market finally crossed the $50/lb hurdle for the first time since 2012.

The Uranium ATM Machine has Awoken the Sector

Sprott Physical Uranium Trust (SPUT) has given the whole sector a giant wake-up call.

SPUT is a publicly-traded investment trust which is a buyer and holder of physical uranium.

You can think of it like the ‘GLD’ ETF in the US which provides investors exposure to physical gold without having to store gold itself.

The SPUT provides passive exposure to uranium.

It provides a way for generalist fund managers and investors to gain exposure to uranium price movements – all without having to buy a miner and take on extra risk.

- Through a technique called an “At The Market” (ATM) facility, the company conducts unit issuances on demand.

So, if a family office or large buyer wants to buy 1 million units of the SPUT, these units can be created and sold to the investor.

The family office gets $1 million worth of SPUT units. And the cash goes to buy more uranium.

Transactions are done at or above NAV, so there is no dilution to current owners of the trust.

The ATM facility can be up to 1x the NAV of the trust.

With the current NAV of the trust around CAD$1 billion, it means that the trust can issue up to CAD$1 billion in new trust units.

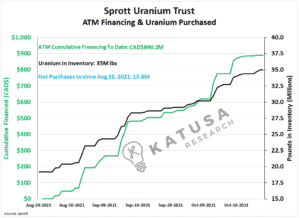

- Since the ATM program began in late August, the trust has taken in nearly CAD$900 million and purchased over 15 million pounds of uranium from the spot market during that time.

Below is a chart which is tracking the daily activities of the trust.

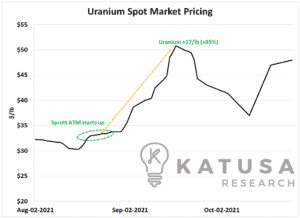

To link uranium prices to the trust, below is a chart of the price impact created through this buying activity.

As you can see the SPUT has sent the price of uranium up 65%, nearly $17/lb higher by clearing out this spot market inventory.

Now SPUT will have competition from the UK…

Yellowcake Uranium has announced intentions to purchase 1 million pounds from Kazatomprom at $47.58 per pound. And 2 million pounds from Curzon at $46.32 per pound.

The current spot price of uranium is $47.25 per pound.

Math Matters

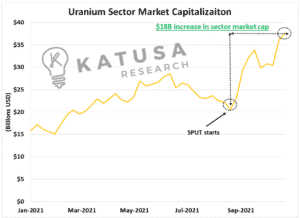

The SPUT has raised nearly CAD$900 million ($725M USD).

- That $725 million worth of spot market inventory buying has increased the sector market capitalization by $18 billion. That is a 25x multiple.

Talk about a return on investment!

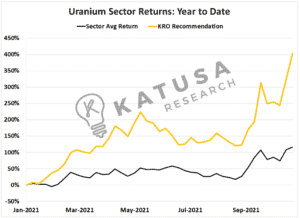

Taking this one step further we can see the direct impact this is having on uranium stocks.

2 Years and 700% Gains: Uranium Price History

Uranium had a dark decade post-Fukushima in early 2011.

- In 2019, the KRO started making noise by backing the first royalty and streaming uranium company in the world.

We followed up by publishing a “faux short report” for Uranium showing that we would do the homework for the shorts.

And if there was a way to still make money in that scenario—what that company would be.

It’s ironic how many people didn’t actually read the report and only cut out and sent along with the “short report” part.

I got a lot of hate because it was seen as “Marin is anti-uranium”.

Nothing could have been further from the truth. And all who spread that false message should be avoided.

The irony of that was at the time I was the largest financier of uranium globally.

After publishing that report I personally backstopped the pre-IPO and IPO financing, which was the largest IPO of the year for mining in the world that year.

Katusa Research subscribers got in at the same time and price alongside me.

There were almost 18 months where nothing happened with the share price.

Lots were going on with the company.

Then within the span of a few weeks, everything changed.

- Investors were piling into uranium.

- Wall Street Bets and Reddit were on fire with Uranium short squeeze posts.

- Twitter and YouTube’s algorithm were full of uranium news and alerts filling up everyone’s feed.

The bullet train was on. Out of nowhere. Or was it?

Not really if you were prepared.

Remember, luck is being prepared when the opportunity presents itself.

And we were prepared. Hence, we were “lucky”.

- Subscribers who invested alongside me in the IPO had the opportunity to be up 700% in 2 years.

Year to date the warrants which came for free in the IPO are up a staggering 1,500%.

Not everything worked out this way and the risks were high.

But deals like this are the definition of the “Katusa Advantage” I do my best to provide.

- [Side Note: Thank you to all of you that wrote in with kind words and comments on the (some extraordinary) gains you made on the uranium stocks we profiled. Those words are exactly what gets me fired up to find the next big idea and research until the late hours of the night.]

So, what’s next? Glad you asked…

The Potential Black Swan – Winter is Coming

I think Europe could have a very cold winter—and with that reliance on Russian reliable and cheap natural gas will be at the forefront.

Boris Johnson, the Prime Minister of the U.K. has “promised” the U.K. citizens he will keep the lights on this winter.

We all know what happens when society must depend on a politician.

Answer: nothing good.

Putin will do what Putin does and optimize this need for natural gas with political leverage. But the nuclear utilities will take notice if this happens and will pay up to the Kazakh demands.

Europe could get hit with a cold winter and very high electricity prices.

And this would be the ideal framework for the Kazakhs to ask a high price for a long-term supply of uranium.

If you own shares in the best uranium companies, you’re prepared for what’s coming.

If you don’t, then consider becoming a subscriber to Katusa’s Resource Opportunities to get the names of our favorite uranium stocks that I’m holding for a bull market run.

After a dormant few years…

I think the fun is just getting started.

Regards,

Marin Katusa